In previous posts we outlined the beginning of some big changes to social security claiming strategies this year.

http://singlepointpartners.blogspot.com/2015/10/congress-makes-changes-to-social.html

http://singlepointpartners.blogspot.com/2015/11/important-dates-for-new-social-security.html

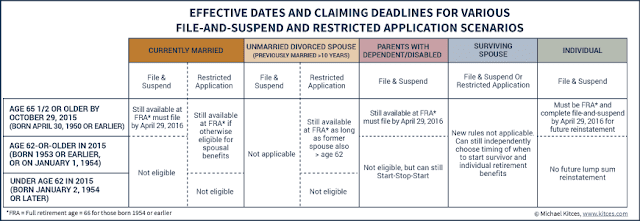

Now that the important date of April 29th has passed what should you be aware of. One item we wanted to draw your attention to is the File & Suspend strategy for individuals. File & Suspend is still an option for individual filers, however, unlike in the past we would recommend NOT choosing this option going forward.

In the past, if a Single Filer chose File & Suspend they became eligible for a future lump sum reinstatements. Essentially, this meant if you went through the Process of Filing & Suspending your benefit (as opposed to simply allowing it to defer by not filing) you were eligible to change your mind going all the way back to Full Retirement Age. If you had a change in health when you were 69, and felt your life expectancy was now going to be shorter, you could go to social security and ask them to retroactively turn your benefit on as of age 66. You would have lost the delayed credit, however, they would have cut you a check for 3 years of your age 66 benefit amount and begun ongoing monthly payments at that time.

Under the new rules, a single filer can still File & Suspend, however, they are not eligible for the reinstatement. So, there is really no reason we can think of to do it. In fact, it could actually be a negative as by not filing at all you have the ability to change your mind and go backwards 6 months on payments. This option may be lost if you go through the File & Suspend process going forward.

In short, going forward, single filers who want to earn delayed credits and have a higher monthly payment from social security (by waiting to collect all the way up until age 70) should simply do nothing and allow those credits to build.

Note: You should make sure 2 months prior to your 65 birthday to call social security and at least sign up for Part A (no premium) of Medicare. If you aren’t covered through another plan at that time you can also enroll in Part B and a supplemental and prescription drug plan as well.