How We Work

We know we aren’t the right fit for everyone, everyone isn’t the right fit for us, or it isn’t always the right time to engage with us. However, we can always be helpful so don’t be shy about reaching out.

First Steps

Step 1: Reach Out

Send us an email at info@spcfo.com and we’ll coordinate a time for a initial conversation

Step 2: Get To Know You

In this initial conversation we’ll first answer any questions you have about Single Point. However, your priorities drive our relationship, so we will spend most of this time learning more about you and the type of help you are searching for.

If Single Point seems like the right solution for you, we’ll outline how we will work together and discuss how to get started.

Step 3: Proposal & Decision

We’ll send you a detailed proposal and contract to review. A benefit of our model is that you don’t need to uproot your financial life or move any accounts to get started. When you are ready to get started, simply sign the contract.

Step 4: We Get to Work!

We’ll get off and running by:

-

scheduling a kick-off meeting

-

building an initial workplan based on your top priorities

-

working closely with you to ease the process of collecting important information and getting organized

-

getting you set up with SingleView (your financial dashboard) and Knudge (our shared to-do list)

-

Is Single Point For Me?

We don’t identify our “best fit” clients by the amount of money they have – we believe those seeking financial advice should be able to access it without having to buy a product or open a managed investment account. Instead, we find that many of our clients share common behavioral characteristics that make them a great fit for Single Point and vice versa.

If the list below describes you, you are probably a great fit for Single Point!

We want to be engaged in the financial decision-making process

We have the ability to manage our own finances, but don’t have the time to make sure every detail is being taken care of

We are willing to be completely transparent about our financial life

We have meaningful income, and thus we feel we pay a lot in taxes. However, we don’t feel like we currently have a great grasp of our tax situation or what we could be doing differently.

We recognize that there are currently overlooked areas in our financial life

We have complexity in life where there is a gap in analysis which is creating uncertainty in decision making

We embrace the use of technology

We prefer low-cost index investments

What Makes Us Different?

Tech Forward: We do planning on your terms. No sitting in traffic for an hour each way to listen to someone blab on about pie charts for an hour.

- We create custom recordings of your planning analysis and our recommendations so you can watch them on your time. This also allows us to spend our time together in a more impactful way.

- When we meet for Strategy Sessions or Working Sessions, we do it virtually (you are welcome to come to the office in person if you like, but most of our clients prefer to meet where they are)

Execution: We are your Accountability Partner. A relationship with us is about more than just advice, it’s about execution. A key component of our role is to be here with you ensuring everything gets done.

Tax Planning: We believe this is one of the most overlooked areas of many financial plans. Tax planning needs to happen on a proactive basis throughout the year, not at tax filing time.

Our Fees: Our unique fee structure is what empowers our process to be so different. Our flat fee is the cornerstone of our belief that clients shouldn’t have to wonder “what’s in it for their advisor?” when making decisions.

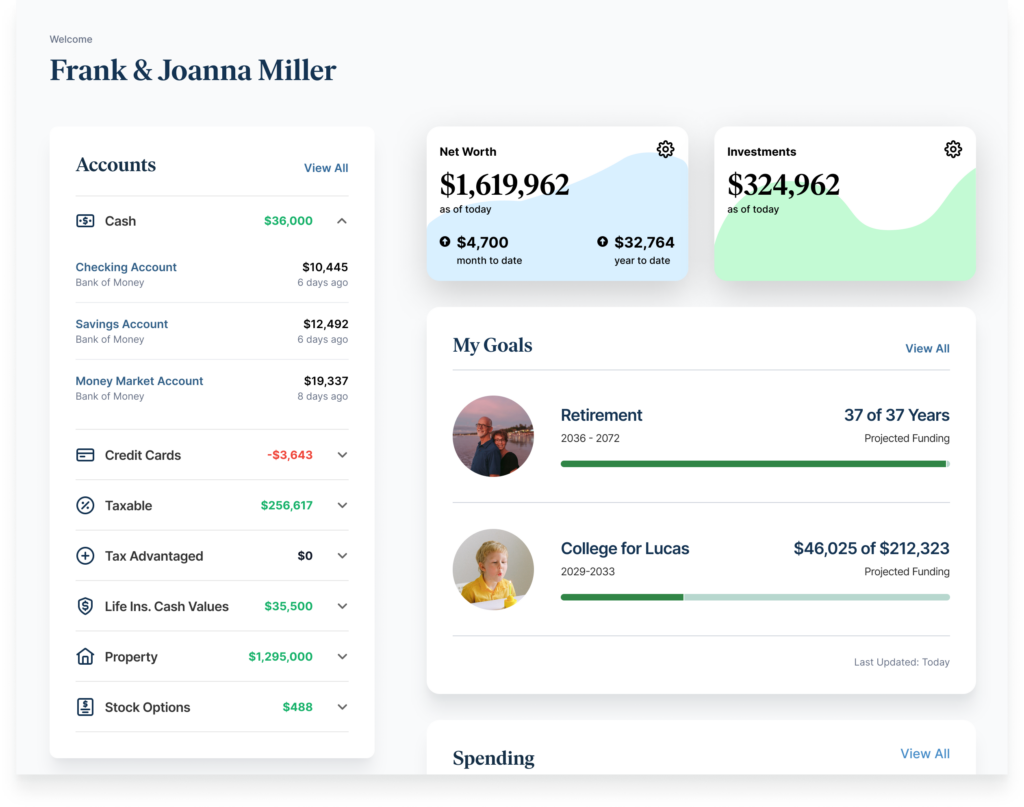

Your Single View™ Dashboard

SingleView™ is your secure online source for up-to-date information of your financial life. SingleView™ utilizes state-of-the-art technology to help provide a single source to securely organize all of our clients’ financial affairs. Its integration with our financial planning software allows us to quickly analyze and advise clients on changes or opportunities in their lives.

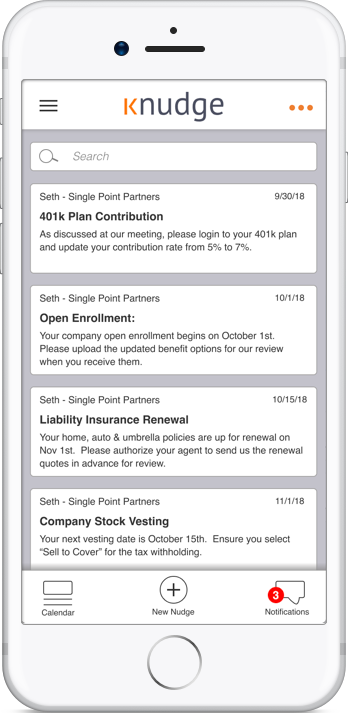

Knudge

Knudge is our shared to-do list that keeps all of the items on your Financial Life Calendar in one place. Knudge also sends reminders to you as important due dates approach. Via Knudge you’ll be able to mark items complete and send us messages on specific tasks right through the app.

In short, Knudge ensures nothing falls through the cracks.

Design A Workplan With Your Personal CFO

We work with you to develop and establish an ongoing workplan of financial tasks that need to be addressed throughout the year. Everyone’s financial life and responsibilities are different – we customize the workplan around your life, schedule, and priorities.

January

- Update Required Minimum Distributions

- Collect/review year-end paystub

- Review retirement contributions and adjust accordingly (catch-up)

- Pay Q4 estimated tax payments

- Review prior year spending and amend budget

February

- Organize all tax documents

- Send customized tax information checklist

- Review and adjust 529 plan allocations

March

- Check for unclaimed property

- Work with CPAs to ensure all tax information received/answer questions

April

- Review tax returns prior to filing/extension

- Ensure all retirement contributions are made for previous year

- Obtain pay stub, update tax projection and pay Q1 estimated tax payments

- Notifications of insurance premiums due and policy renewals

May

- Collect and review tax return

- Review tax withholdings and adjust W4 if necessary

- Download and review Social Security statement

June

- Obtain pay stub, update tax projection and pay Q2 estimated tax payments

- Ongoing tracking and monitoring of cash accounts and credit card balances

- Track out-of-pocket medical expenses for the year to better analyze appropriate plan going forward

July

- Review estate plan and flowchart to consider revisions/updates (every 3-5 years or due to a life event)

- Review of your investment risk tolerance

- Collect and review P&C declaration pages

- EverSafe subscription for credit monitoring

August

- Run your free annual credit report

- Review your energy bill and utility provider options and costs

September

- Obtain pay stub, update tax projection and pay Q3 estimated tax payments

- Review beneficiary designations on all retirement accounts and insurance policies

October

- Complete financial aid applications/FAFSA

- Collect and review benefit options during open enrollment

- Review Medicare selections with open enrollment (MediGap, supplemental policies, and Part D)

- October tax returns filed if on extension

November

- Review charitable contributions

- Utilize funds in flex spending account

- Ensure all RMDs will be completed prior to year-end

- Analysis of new/vested stock options

December

- Analyze YTD income for year-end tax planning opportunities

- Roth Conversions

- Tax Loss Harvesting

- Net investment income surtax, Medicare premium brackets, marginal tax rate

- Gifting strategies

Your Financial Life Calendar

In today’s world, with seemingly endless financial choices and decision-points, managing your financial life can become complex and even overwhelming.

Our goal is to simplify your life and the decision-making process for these various financial choices, helping you to be more informed, confident, and decisive. We serve as an accountability partner on the various financial tasks that need to be accomplished throughout the year because we know all the little things add up to make a big difference.