As part of the Federal Budget deal passed by Congress (still to be voted on by Senate) there are a couple of major changes to both Social Security and Medicare.

Social Security File & Suspend Claiming Strategy Eliminated:

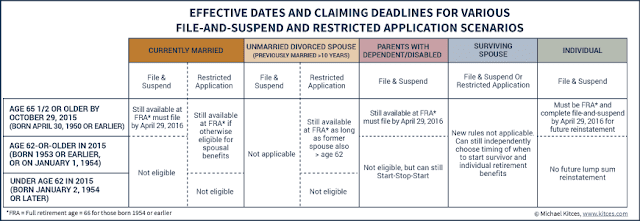

We have worked with many clients to develop a plan to maximize social security benefits. Often times, this planning included a strategy commonly called File & Suspend. This strategy allowed one spouse to collect benefits off of the other spouse’s record from age 66-70, allowing their own benefit to continue to grow. At age 70 they would switch to their own benefit.

This legal strategy has been deemed a “loophole” by Congress and this pending bill will eliminate it. It is still a little unclear if it will affect those currently implementing the strategy, although some amendments to the bill seem to suggest it will only affect those looking to implement in the future.

This bill will cause us to revisit our plan with many clients who are approaching Full Retirement Age as defined by social security.

For more details on this, here are two great resources:

Michael Kitces and Mary Beth Franklin

Medicare Premium Increases:

For those in higher income tax brackets (starting at MAGI over $85,000 for single filers and $170,000 for joint) premium increases on Medicare Part B are going up (see below chart for 2016 estimates). However, there is also a group of people on Medicare in the first tier who were exposed to Premium Increases as well. Those who are on Medicare and currently collecting Social Security benefits would see no increase in premiums in 2016 under what is known as the “Hold Harmless” provision. However, those who are on Medicare but not collecting Social Security (either due to Government Pensions or Social Security Claiming Strategies such as the one above) were set to bear the brunt of the increase.

That group was going to see their premium rise from $104.90 to approximately $165. However, Congress has also announced they are capping the increase to this group at $120/mo, a more manageable $16/mo increase. Click here for details on this announcement.

We recognize that those currently deferring social security benefits may look at this as a trigger to start those benefits sooner to avoid the increase. We do not believe this is a good strategy for you.

Yes, we would like to avoid any premium increases in possible, however, what you would be giving up in increases to future social security benefits will dwarf what you would be saving in premium increases. Here’s another link that discussed the number behind that in more detail.

Bottom Line:

With these pending changes, the next 6 months will be a good time to review your strategy for Social Security Claiming strategies, and review your Medicare choices. You have until December 7th to make changes to your current Medicare supplemental plans and prescription drug plans.

| Modified Adjusted Gross Income (MAGI) | Medicare Part B Premium + IRMAA 2015 | Estimated* Medicare Part B Premium + IRMAA 2016 |

|---|---|---|

| Individuals $85,000 or less, married couples $170,000 or less | $104.90 | $104.90 (hold harmless), $120 (not held harmless) |

| Individuals $85,001 – $107,000, married couples $170,001 – $214,000 | $146.90 | $171 |

| Individuals $107,001 – $160,000, married couples $214,001 – $320,000 | $209.80 | $243 |

| Individuals $160,001 – $214,000, married couples $320,001 – $428,000 | $272.70 | $315 |

| Individuals above $214,001, married couples above $428,001 | $335.70 | $387 |