With the U.S. presidential election approaching, many investors are asking themselves: “Should I adjust my portfolio ahead of this election?” While you may be seeing worrisome headlines from both sides of the aisle, it is important to understand the historical correlation between the U.S. stock market and our presidential elections.

Our consensus is that although elections may cause short-term movement (noise) in the markets, we still are confident in the long-term financial plans we have constructed with our clients, regardless of which candidate is elected. This echoes the wise words of our CIO, Rene Jarquin, from four years ago.

This guide, provided by YCharts, highlights the importance of remaining invested through these unsettling times, backed by several data points.

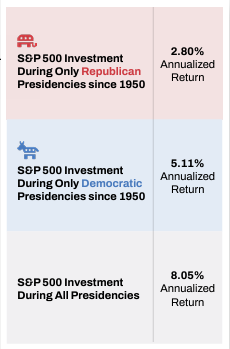

I found the chart on page 5 especially insightful. It reinforces our belief that “being invested only during Democratic presidencies, then moving to cash for Republican tenures, or vice versa–is probably hurting your portfolio more than helping it.” Dating back to 1950, a $10K investment in the S&P 500 would have appreciated above $3M; had you only been invested during Republican presidencies or Democrat presidencies, you would have left at least $2.5M on the table. “Regardless of the party occupying the Oval Office, staying invested is the most prudent long-term strategy.”

If you are interested in seeing the full report, click on the below.