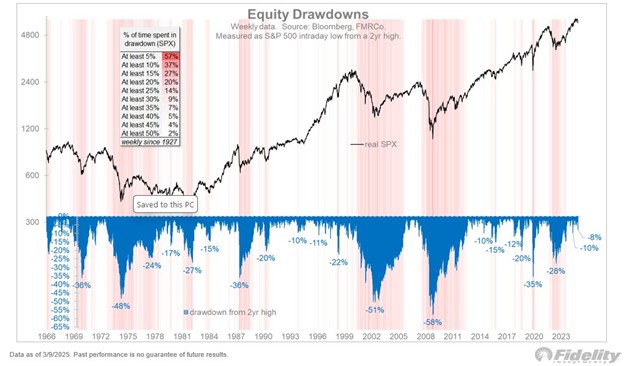

A full-blown trade war, though unlikely, would be very damaging to equities.

What happened?

President Trump announced that he plans to impose a 25% tariff on imported steel and a 10% tariff on imported aluminum.

Why does it matter?

A ‘full trade war’ is not something we have seen since the Smoot-Hawley Tariff Act of 1930 which made the Great Depression even worse. I doubt we get to that point, but we can expect a rough ride as the headlines will magnify the risk and some market participants will no doubt sell on the headline. While we are vigilant we also must be attuned to the higher probability outcome – that our trading partners swallow this pill like they did under Reagan in the 1980s and under Bush in 2002.

Multinational companies would be hurt the most, so higher exposure to smaller, US-centric companies would also make sense. Foreign sales represent 31% of S&P500 companies’ total sales; whereas for the S&P 600 Small Cap Index it is only 17%. The S&P500 however has a higher valuation multiple relative to profits because of the large weightings of fast-growing Tech firms like Apple, Google, Facebook – which are seeing massive growth abroad. For the global tech/pharma sectors foreign revenue is already 35% of total sales and they would stand to take a big hit if access to foreign markets were closed or curtailed. We are watching this very closely since the high valuation multiples have priced in major growth abroad.

The road to a full trade war is really a series of political decisions and one which will unfold over multiple episodes. The Trump administration is the dominant player but not the only one – congress will have a chance to weigh in and affirm the final NAFTA agreement. There are also indications that Trump is using access to our market as a carrot to extract concessions in other areas like mutual defense, immigration. His approach will no doubt create some anxious moments.

How are we responding?

We are tracking our trading partners’ response to the steel tariff just announced. Interestingly Canada, Japan, Brazil, Korea, and Germany are the ones most directly impacted by this. China exports very little of their steel to the US, but it does sell a much larger amount into Europe and Asia. Whether these allies respond rationally or irrationally remains to be seen. It is important to note that even our European allies have been hurt by China dumping their excess steel into their market. A probable outcome is for Europe to impose tariffs on Chinese steel until the over-capacity caused by China’s state-owned mills is curtailed.

Our Outlook:

A full-blown trade war, though unlikely, would be very damaging to equities. Not only would global sales be adversely impacted for blue-chip multinationals but they would also see profit margins squeezed given that retaliatory tariffs on our part would expose their current offshore supply-chains to higher sourcing costs.

Large foreign holders of US Treasuries could also decide to unload their US Treasury holdings which would certainly cause turmoil in the bond market as well – hence the role of cash.

In the 1980s Reagan put major import quotas on a wide variety of European and Japanese products – back then, our allies reacted rationally and did not retaliate. They did not want to jeopardize access to our market which represented a very large % of their exports. We will see if similar calculations prevail this time around.