Help(ers) Wanted!

Financial Planning is a helping profession. We’re searching for our next “helper” to join the Single Point Team.

Single Point Partners is a financial planning firm built for families looking for more than just advice. Our clients value our partnership in making sure things get done.

Is Single Point the right place for your career?

Open Positions

Currently looking for our next: No Current Openings

Apply Here

Roles at SPP

A Little About The Role

We’re very excited about what we are building here at Single Point. We are growing at a strong pace with a laser focus on doing remarkable work for our clients. This means having the right people in the right seats on the bus, and ensuring that our team is not stretched thin by the growth. With that, we are looking to hire our next Personal CFO, this is SPP-speak for lead financial planner.

What You’ll Be Doing (High Level)

What You’ll Be Doing (The Details)

The growth of our business tends to be with a younger client base than the traditional firm, ie. It is not made up of retirees but of families in the middle of successful careers with a lot on their plates. This is not by accident, but by design based on the client experience we have built which focuses on both advice & execution across our clients entire financial life.

We’re looking for a financial planner who wants to focus on doing just that, great planning as opposed to an asset-gathering mindset. CFP required. Would look favorably upon someone with (or working towards) an EA, CPA or LLM background although its not required.

The approach we take in training is to do joint work with other PCFOs for the first 10-15 clients you take on as a lead as well as working closely with our centralized resources on the financial & behavioral planning, tax planning & investment.

See our Personal CFO Career Path (below section) for more details.

What You Won’t be Doing

This role is a bit different than similar-titled roles in other wealth management firms…

We think interested candidates should know what the role is NOT:

- No – Prospecting – we are looking for talented planners to work with the growing demand for our services

- No – Being on your own – we work in a team environment to deliver the best possible experience to our clients

- No – Executing trades & money movement – we have central resources on the investment (and tax) front to execute

List of Qualities it would be cool if you had

- Curiosity – The instinct to ask great questions, and to dig a bit deeper below the surface.

- Empathy – It’s hard to imagine someone being effective in any “helping-based” career without the ability to understand and share the feelings of others.

- Listening – We start all meetings with a reminder that the agenda isn’t about us, it is about hearing from our clients and listening to their priorities.

- Attention to Detail – Our financial lives are complex. A strong framework & organization of them requires precision.

- Resourcefulness – No one person can have all the answers. It takes a team. Knowing where to find the right answers to the right questions.

- Proficiency in technology a must – experience with eMoney is a plus

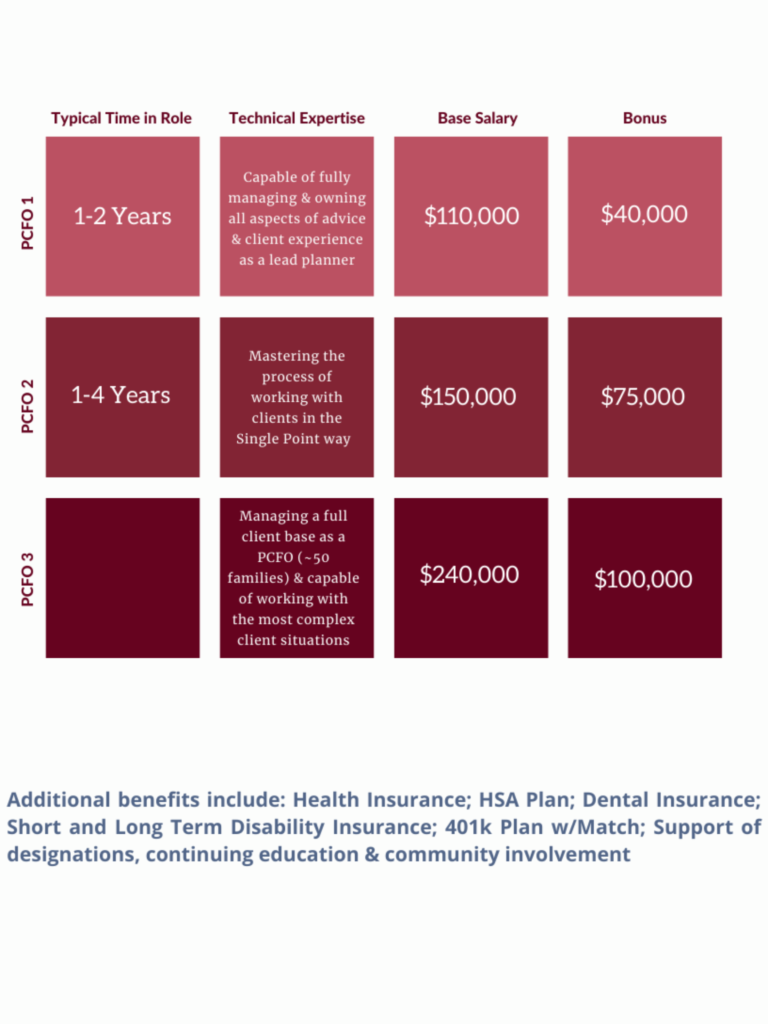

What do you get paid?

A Little About The Role

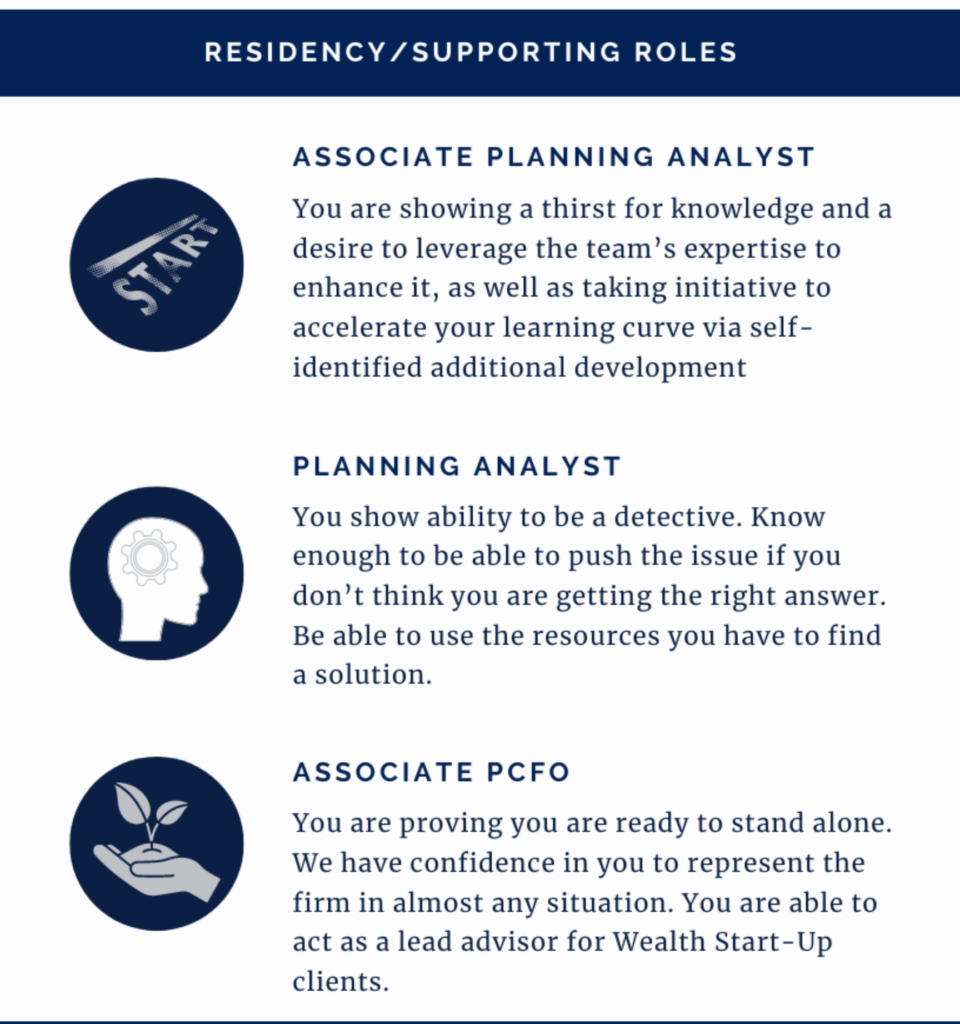

At Single Point, the Personal CFO is the engagement lead and is supported by a dedicated Planning Analyst who acts as the ‘right hand’ of the PCFO. Our PCFOs and PA’s are all practicing CFPs (or on the path towards it).

What You’ll Be Doing (High Level)

What You’ll Be Doing (The Details)

The PA role is expected to be a stepping-stone to a career as a lead PCFO and should be viewed similar to a ‘residency’ where the resident has the chance to learn the science and the art of advising families by shadowing and supporting a seasoned lead PCFO. The role is designed to ensure the resident gains deep first-hand knowledge of a broad range of clients’ financial profiles, but also to be able to identify and analyze the clients’ behavioral and communication styles.

See our Personal CFO Career Path (below section) for much more details on the day to day of the role.

What You Won’t be Doing

This role is a bit different than similar-titled roles in other wealth management firms…

We think interested candidates should know what the role is NOT:

- No – filling out custodian’s paperwork

- No – Executing trades & money movement – we have central resources on the investment (and tax) front to execute

- No – Prospecting for new business

List of Qualities it would be cool if you had

- Organization – a key competency is ability to track and organize tasks/action-items across 40+ families

- Curiosity – The instinct to ask great questions, and to dig a bit deeper below the surface

- Resourcefulness – No one person can have all the answers. It takes a team. Knowing where to find the right answers to the right questions

- CFP® or on the path to becoming one

- Proficiency in technology a must – experience with eMoney is a plus

What do you get paid?

A Little About The Role

We are looking for a Client Service Operations (CSO) professional to work with our Personal CFO teams (SPP speak for lead financial planners). The ideal CSO would describe themselves as being maniacal about ensuring action items get done. Our CSOs are asked to juggle multiple tasks at one time and therefore need a strong sense of how to prioritize. We like to think we’re pretty flexible so the role can be virtual if desired.

What You’ll Be Doing (High Level)

- Account Opening/Maintenance & Money Movement (75-85%)

- Contract Renewals and billing (~15%)

- Maintaining clients’ data connections (5-10% / overflow)

Still interested?

What You’ll Be Doing (The Details)

- Account Opening/Maintenance & Money Movement

- Provide support to clients for new account on-boarding, account changes, deposits, withdrawals, gifts, transfers (we are almost 100% paperless)

- Serve as on-going liaison with custodians (e.g. Fidelity)

- Margin / ICL set-up and maintenance

- Be a resource for our Personal CFOs (lead planners) to troubleshoot in interactions with clients and the custodians of their held-away accounts

- Help clients grant SPP authority over non-managed accounts (e.g. 529s, DAF)

- Contract renewals & billing:

- Update & deliver contract renewals for existing clients

- Generate contracts for new clients

- Maintain records of account billing within our portfolio reporting system (Black Diamond)

- Maintain clients’ data connections

- Accurately link, label, and group client accounts into portfolio reporting system

- Working directly with clients to establish and maintain data feeds via aggregation software (Plaid)

What You Won’t be Doing

This role is a bit different than similar-titled roles in other wealth management firms…

We think interested candidates should know what the role is NOT:

- No – Printing and binding power-point decks (we work in a heavily virtual environment so very little dealing with paper)

- No – Preparing marketing materials and other client mailings

- No – Executing trades

List of Qualities it would be cool if you had

- Proficiency in technology/applications a must – experience with Fidelity Wealthscape, BlackDiamond, Wealthbox, Excel/Word, and Docusign, is a plus

- Attitude that no task is too small and a willingness to do whatever tasks are necessary to make sure that the work is done on time

- Enjoys making personal connections with the firm’s clients

- Acute focus on ‘owning’ the outcome

- Bachelor’s degree preferred but not required

- Open to remote work arrangements

- 3 years of experience with registered investment advisory firm operations (or brokerage, private bank)

What do you get paid?

- Probably $60,000 – $85,000 depending on your experience.

- There’s also the potential for some additional $$$$ via our bonus program.

- We also think we are a pretty cool place to work, and have some decent benefits to offer a full-time person (health/dental insurance, 401k plan with match, and a minimum not maximum vacation policy – you have to at least take 2 weeks off per year).

We can answer all the more detailed questions around comp, benefits and what it’s like to work at SPP for the candidates who we interview.

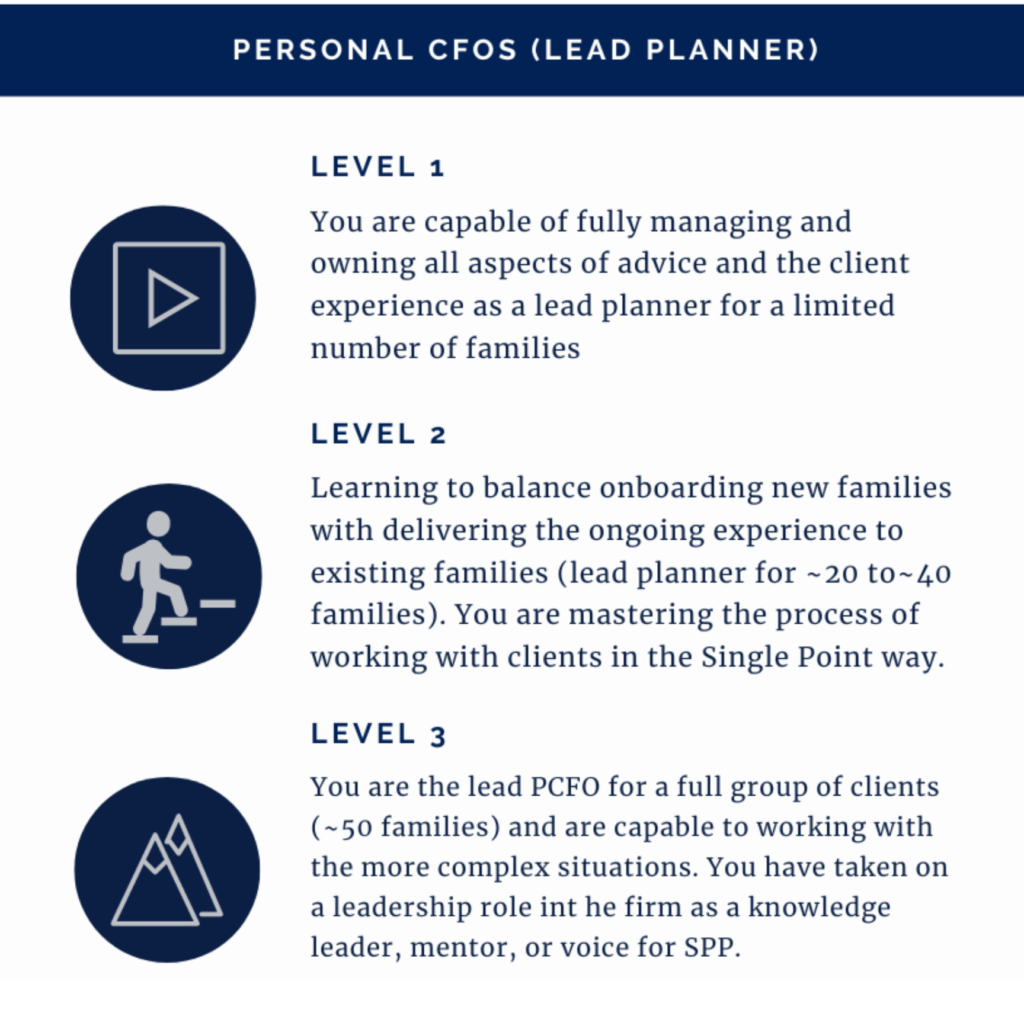

Personal CFO Career Path

At a high level, we have 2 separate career paths:

- Personal CFO (otherwise known as a lead financial planner)

- The Team Supporting the Team (internal roles that support the PCFOs & PAs deliver the experience to clients of the firm)

Check out our detailed Career Path journey highlighting the stages of growth and progression for our Personal CFOs.

Is Single Point right for you?

Our team has come from all sides of the financial services industry, the one word that is mentioned most often when we ask new hires to describe SPP: Different

If you are interested in developing your skills in both the art, and science of financial planning in a supportive, collaborative team environment (with none of the typical expectations of being a salesperson instead of a giver of advice), Single Point may be the place for you.

SPP Core Beliefs

When someone is referred to us or finds us our top priority is to ensure they leave the interaction with us having helped them, not that they become a client. We aren’t the right fit for everyone, everyone isn’t the right fit for us, and it isn’t always the right time for them to engage with us. However, we can always be helpful. This might mean simply answering some questions or finding them a resource. But we take the time to help. The mindset to help others is critical to financial planners.

We have purposefully designed SPP to operate as a team. Clients are considered clients of the firm, not of any one of us. We know that by working together it will bring the best possible experience to our clients. That is why we have tried to design all aspects of our organization through a lens of teamwork, from compensation to communication to use of technology.

We help each other. The team is full of individuals who are willing to share the expertise and time with each other to help make for the best possible client experience no matter who is responsible for delivering it.

Transparency and simplification of fees is one of the core differentiators of SPP that empowers us to engage with our clients under the Personal CFO approach, where the client’s priorities – not ours – drive the relationship. With that, we also believe in transparency internally as a firm. We hold monthly firm meetings where you are encouraged to ask questions or bring ideas for us to improve. We also hold monthly one on one meetings focused on your growth which allows another opportunity to express any feedback, concerns or questions.

We believe in simplicity wherever possible. This includes our planning & investment philosophies. Our goal is to simplify our client’s lives.

No one expects you to have all the answers. Feel comfortable saying “I don’t know”, both internally and to clients. With that, we expect it to always be followed by “but I’ll help you find out”. It is ok to make mistakes too, when we make them we work to correct them together.

Also, mistakes happen and that is ok. We approach mistakes as opportunities to learn how to improve our processes to avoid them in the future. We are upfront and transparent about mistakes with clients and with each other.

We prioritize time for pro-bono work. As financial planners we have a unique set of knowledge that can help so many people. The reality is most people who truly need financial advice can’t afford it (or feel like they can’t afford it). It’s important to us to participate in opportunities to share this knowledge we have with those in need. We typically do this via the pro-bono programs made available through the FPA.