The reality is, with all of the security breaches over the past few years, your data has likely been accessed. The key to protecting yourself is to be vigilant about monitoring your assets, transactions, and credit.

One of the most effective steps you can take is to freeze your credit. You can place a credit freeze with the three credit bureaus by phone or online. There is no charge to place a freeze on your credit. Below are the steps to take to do just that with all 3 credit agencies.

Instructions by Phone:

It’s simple, just call the three numbers below:

- Equifax 800-685-1111

- Experian 888-EXPERIAN (888-397-3742)

- Transunion 888-909-8872

Online Instructions:

If you prefer to do this online, visit the three sites below and follow the instructions.

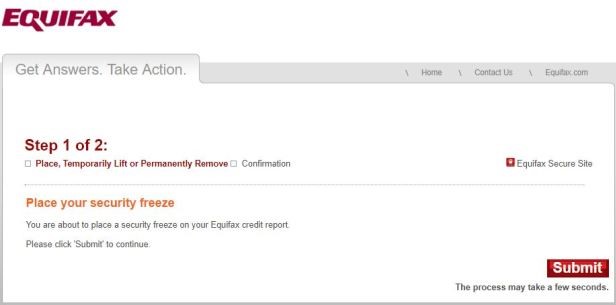

1. Equifax

https://www.equifax.com/personal/credit-report-services/

Click GET STARTED (on right hand side of the screen)

The company asks for your First and Last name, Date of birth , Mobile number (optional) and Current address

Once you’ve entered that information, click CONTINUE and you will be asked to set up an account. Your username will be your email address and you will create a password. You will asked a series of security questions.

Log on and you’ll be redirected to a welcome page with “Freeze” and “Alerts” on it. Click “Freeze” and it will take you to the online hub where you can place credit freeze on your Equifax credit report.

Once you accept the terms of use, press the Next button. Here is where you’ll be taken to Step 2 to freeze your credit. You’ll see a button that says Submit.

Once you press the Submit button, you will be prompted to view a PDF document that contains your PIN. Do not lose it. It should also be noted that a PIN is no longer required for online security freeze transactions, but you will need it for any credit freeze transactions done via phone or mail.

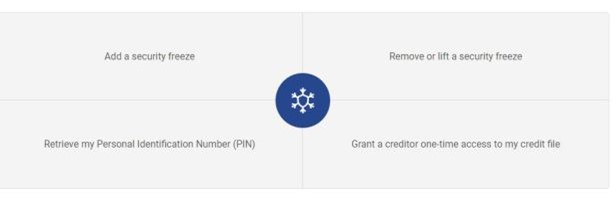

2. Experian

https://www.experian.com/freeze/center.html

Once you press the Add a security freeze, it will take you farther down the page, where you’ll need to apply.

Once you press the “Add a security freeze,” it will take you farther down the page, where you will click Freeze my own file

Experian will take you to a form where you’ll have to fill out your personal information: First and Last name, Address, Social Security number and Date of Birth

Next you’ll be taken to an identity verification page. It will ask you a number of questions about your financial activities. You’ll need to select the answer from multiple choice options. One of the questions will be something like: “According to your credit profile, you may have opened an auto loan in or around April 2002. Please select the lender for this account.”

Once you are verified, you will be prompted to put a security freeze on your account. You will then be issued a PIN. Do not lose it.

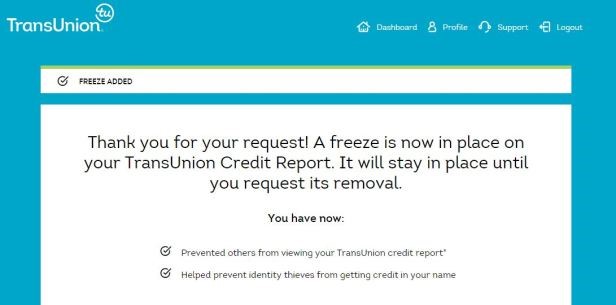

3. TransUnion

https://www.transunion.com/credit-freeze

Just click the Add Freeze button at the bottom of the page.

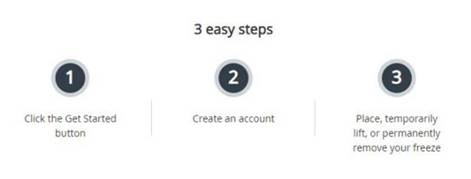

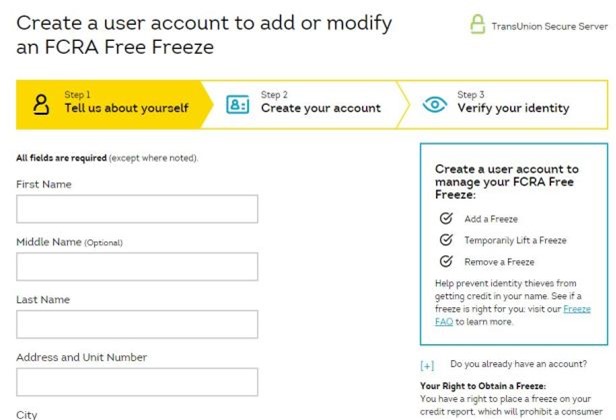

Step 1

It will take you to a page where you need to create a user account. Once you add your information, it will generate a user account.

Step 2

Next you will be asked to create your user account.

Step 3

Verify your identity by answering a series of questions.

Click CONTINUE and on next page ADD FREEZE

You’ll be prompted to log on. Once you’re into the system, you’ll be able to set up a PIN. On this page, you’ll see a box to “Confirm your PIN.” Unlike the other credit-reporting agencies, this will only be a six-digit number. Do not lose this.

Please note: When doing any TransUnion credit freeze transaction online, your PIN is not necessary. Any such transaction by phone or via mail will need the PIN. Once you set up your PIN, you’ll need to press the “Continue” button to freeze your credit. Once you do that, you’ll see a page that says “Freeze added.”