This week in our continuing series on the impact of the election we tackle income taxes. If you missed last week on investments you can check it out here.

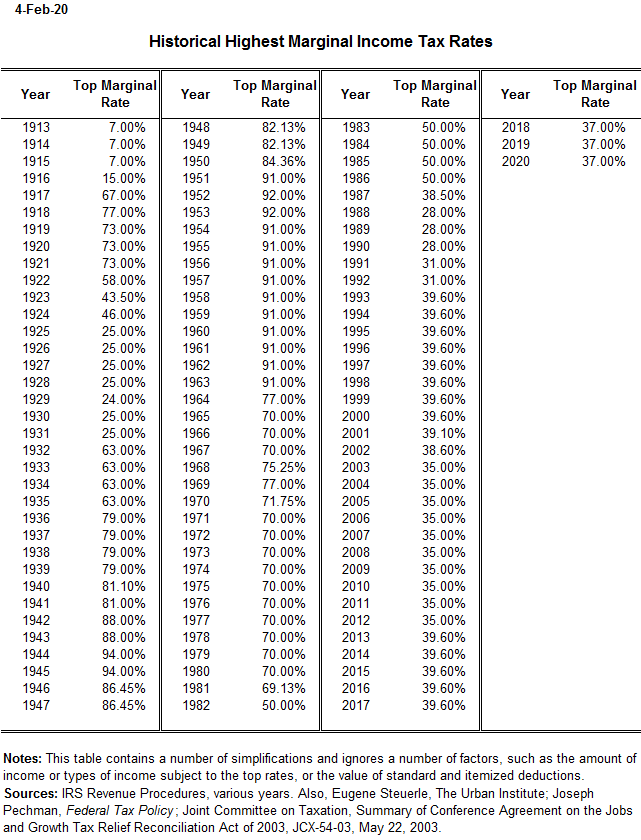

Below is a chart showing the top marginal tax brackets since 1913. What stands out (beyond the fact that the top marginal tax bracket in the 1950s was over 90%!!!) is that our current marginal tax bracket is historically low. Beyond that, individuals and investors also typically benefit from preferential tax treatment on certain types of income, such as long-term capital gains, qualified dividends. The top tax bracket for long-term capital gains is 20% – a full 17% lower than the top marginal bracket for ordinary income!

There’s no surprise here, but the presidential candidates are divided on this issue as well. President Trump has been adamant that he would like to find ways to continue to cut taxes (although no plan has been formally put out there to do so). While Former VP Biden has been a bit more transparent with his tax plan in broad terms. Several key components of Biden’s plan for income tax purposes:

- Repeal the TCJA components for high-income filers – this would essentially move the top tax rate from 37% back to 39.6%

- Impose a 12.4% Social Security payroll tax for wages above $400k – a clear attempt to replenish the rapidly depleting Social Security Trust fund. Currently Social Security wages are only taxed up to $137,700

- Increase corporate income tax rates from 21% to 28% and establish a corporate minimum tax on book income

- Tax long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6% on income over $1MM (essentially a tax increase of almost 20% for those affected!)

- Restore the Pease limitation and phase-out itemized deductions for taxable income above $400k

- Phase-out qualified business income deduction (Sec. 199A or commonly referred to as QBI) for filers with taxable income over $400k

- Biden has insisted that his tax plan would not impact those households earning under $400k/year in a meaningful way

- Rather than allowing for a deduction for retirement account contributions, Biden has proposed replacing that deduction with an income tax credit for 26% of the contribution. The net of this change is that retirement account contributions become far more appealing for those with marginal tax brackets below 26%. Those in marginal tax brackets above 26% will lose some of the appeal of making pre-tax contributions to retirement since a) the credit is lower than their marginal tax bracket and b) distributions will still be fully taxable when later taken out!

The finer points of the tax plan for those earning less than $400k remain to be seen, but the proposed changes would have a substantial impact on high-earners. For those who are potentially impacted and believe Biden may win the election/the Democrats will win the Senate, you may want to consider taking long-term capital gains this year. These changes could also make the tax deferral aspect of low-cost, non-qualified annuities very appealing for high earners (the insurance industry would be thrilled with that!).

Conclusion:

Depending on your risk tolerance for tax rate increases and the impact that could have on your broader financial situation, it’s worth starting to think about a plan to address some of these tax policy risks that exist. We’ll have a bit more clarity of where things could head after the election in November which gives most individuals almost 2 months to take action for the current calendar year 2020

PS. Stay tuned for our next installment as we address estate taxes.