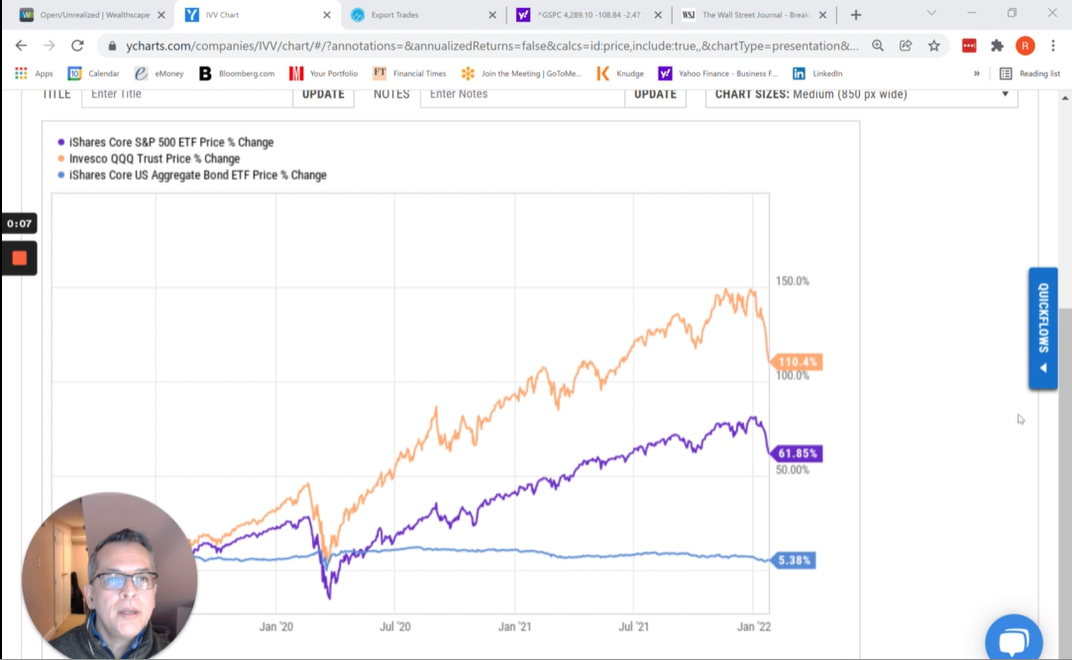

Effect of the Magnificent Seven Stocks

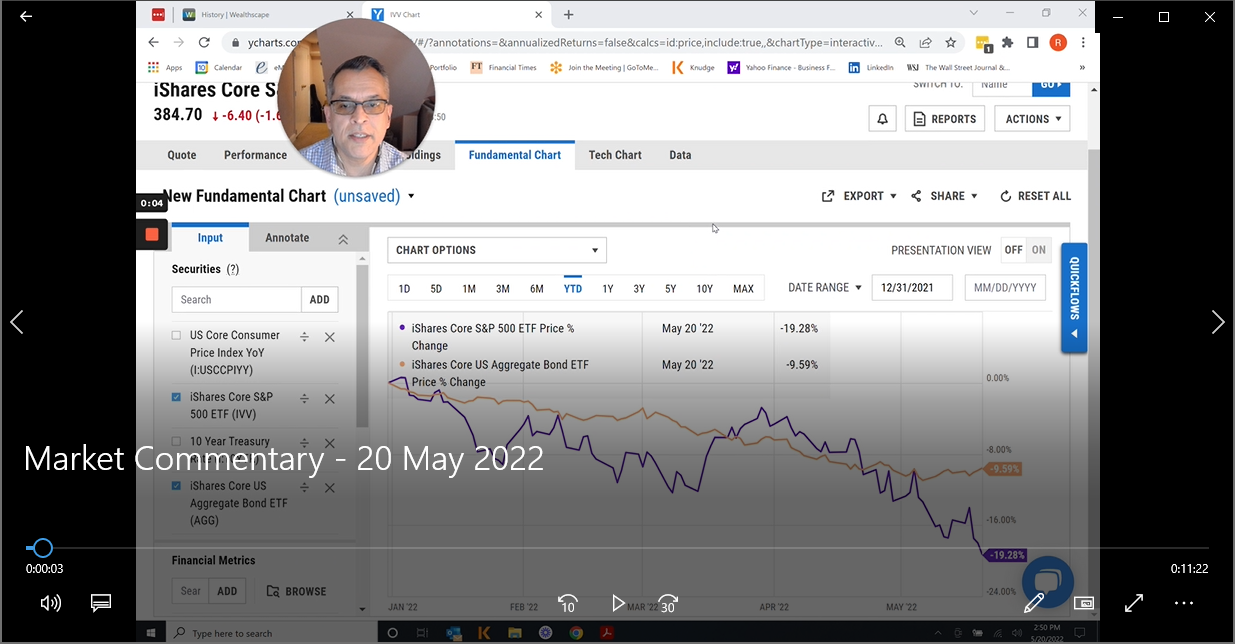

Rene Jarquin July 2024 Market & Portfolio Commentary The S&P 500 Index has become very lopsided due to the run up of the 7 largest stocks in the index. While we have benefitted from this run up as index investors, this level of concentration can cause some anxiety and questions of what we should [...]