Back in July, Rene posted a video answering the question: “Should I change my portfolio before the election?” (if you missed it, you can check it out here: https://spcfo.com/should-i-change-my-portfolio-before-the-election/).

Being the data nerd I am, I thought I would add onto his post with a little additional context.

The reality is that a change in the political landscape has traditionally been a non-event from an investment perspective over the past 94 years. If history can give us any insights, then it seems therapeutics to manage COVID-19 and a potential vaccine will likely have a much greater impact on the financial markets than the election will. This is not a prediction on the short term stock market movement that can occur around election day (or in the weeks that follow).

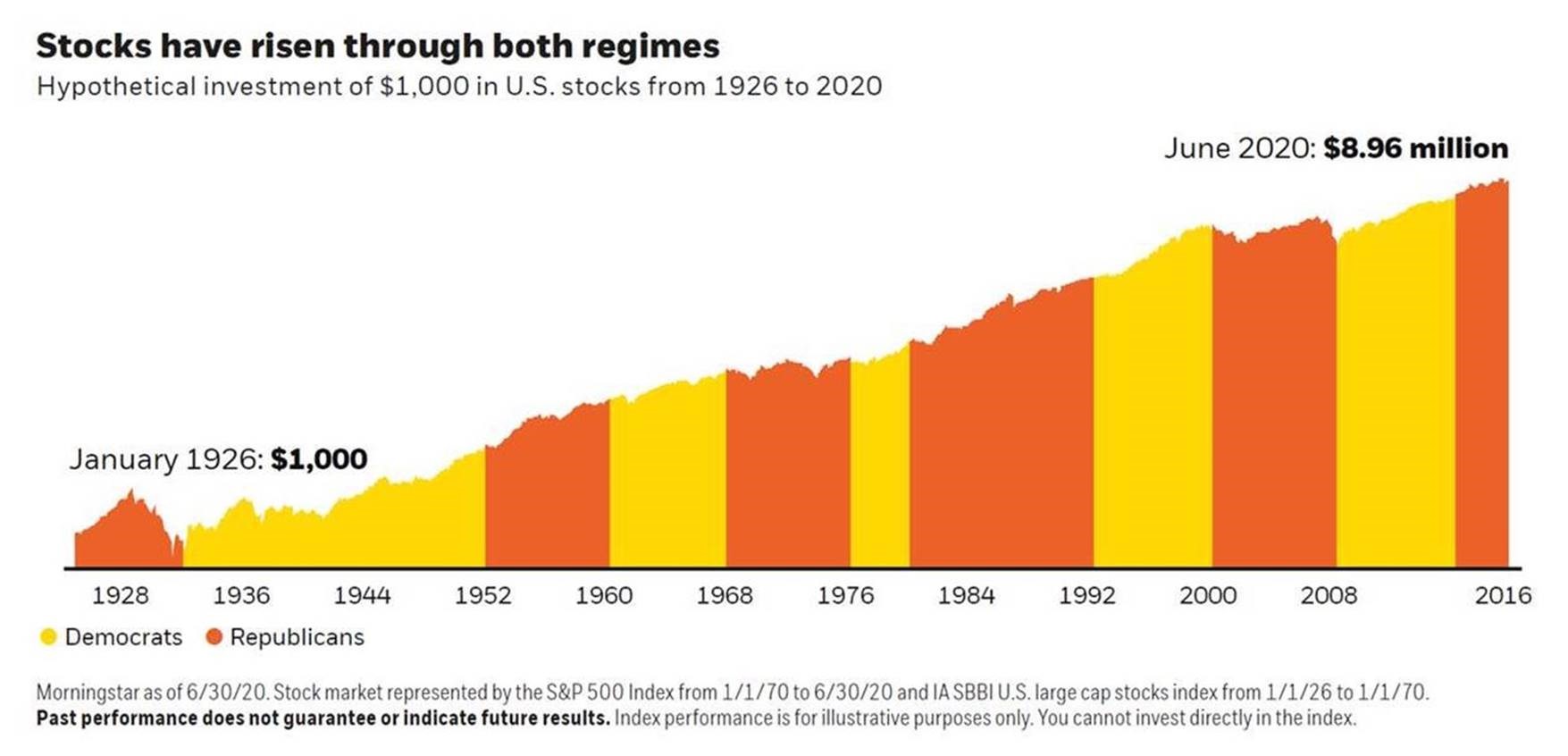

Below is a chart showing the growth of the US stock market through different political regimes over the years. Regardless of whether Democrats or Republicans hold the White House, the trend is clear – over the long-run, it’s a safe bet to assume equities will grow regardless of who occupies the White House.

This is a major reason why we at Single Point don’t believe in being ‘tactical’ with your investments – our goal is to focus on what we can control which is to get our clients market returns over the long-run while minimizing fees and taxes. The data simply has not shown that market timing and active stock picking strategies reliably help a client outperform the index over long time periods on a net of taxes/net of fee basis. Dialing market exposure up or down based on some political crystal ball is a fool’s errand – it’s just market timing. If the dollars committed are long-term dollars the current political cycle is a distraction.

PS. With that being said, the political landscape (especially control of the Senate) could significantly impact another areas of our clients’ financial lives – taxes! Stay tuned for a follow up post on this.