Groucho Marx famously said… “I would never want to join a club that would have me as its member”

Similarly, banks love nothing more than to lend to borrowers who have no need to borrow.

And the high-net-worth clients of banks’ brokerage or wealth management units are an obvious object of their affection: the portfolios they manage for these families serve as a ready-made pool of high-quality collateral that requires little due-diligence up-front, and that offers the bank complete control and the prospect of full repayment via bank-triggered liquidation should a client default on the loan.

It is not intuitive why a wealthy client would feel the urge to borrow. Yet Wall Street’s 3 largest brokerages (BofA-Merrill, Morgan Stanley, UBS) have over $100 Billion in portfolio loans outstanding. In total, this number might approach $250 Billion across all US banks. (source WSJ.)

Wealthy families often need to raise cash to purchase real-estate, make private investments, pay for private education, etc. And selling down a portion of their stock-&-bond portfolio might not make sense at that particular point in time because of tax or market-timing concerns. (To be clear, there are times when using a portfolio loan as a bridge makes a lot of sense such as when there is a mismatch between a home purchase that needs to close before another property sells.)

As is too often the case with big banks, the push to ‘distribute’ products through their Financial Advisor (FA) salesforce has turned the Securities-Based Lending program into another source of compensation for FA’s. Below is the typical ‘pitch’ to FA’s, usually couched as a way to ‘improve’ your practice:

- use credit lines to ‘lock-in’ the client and make it harder for them to leave;

- avoid selling-down the portfolio off of which your fee (and commission) is calculated;

- and finally, earn additional compensation generated by the incremental revenue tied to the loan balance.

We know the above to be true because we have had banks come in and give this same pitch directly to us! They obviously didn’t do their homework on Single Point to know that is not the way we work.

Having come out of the big bank world I can tell you that it is absolutely true that clients with more than one product relationship tend to turnover a LOT less. These are often the bank’s most profitable clients. So, cross-selling has become the holy grail at every bank – whether they cater to middle-income families (like Wells Fargo)… or to the well-heeled (like JP Morgan, Goldman.)

The push by Wall Street to cross-sell credit to their Private Clients has reached a level never seen before. No doubt that for some families these credit lines are a convenience that can help bridge them through a short-term cash squeeze. But far too often we come across families who have been using these credit lines to cover longer-term cash deficits, and while the client is ultimately responsible a ‘Financial Advisor’ who has a personal interest in promoting the use of credit is hardly worthy of the name.

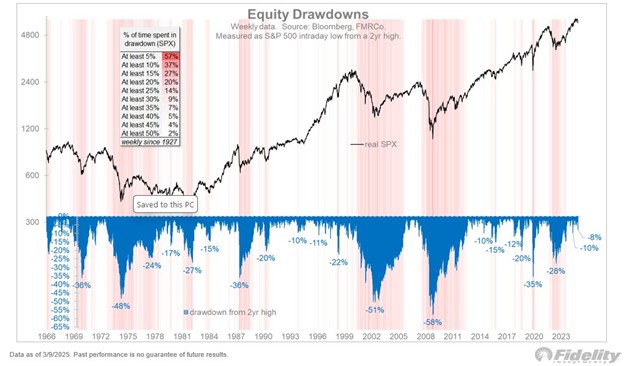

I would be remiss if I didn’t say that with interest rates headed higher the logic of keeping these credit balances becomes much less compelling. For clients coming in with credit balances we are spending time analyzing optimal pay-down plans: balancing the tax hit of raising cash at year-end versus the risk that comes from additional months of carrying stock market exposure funded with debt.

If you find yourself in a position where using a bridge loan against your portfolio might make sense we suggest you do so only after putting a detailed plan together on how you will repay the debt, and, how you will amend that plan if circumstances change. Simply saying we’ll pay it off later is not a plan.

Additional Reading can be found below:

https://www.wsj.com/articles/wall-street-needs-you-to-borrow-against-your-stock-1501147801

https://www.fool.com/investing/2017/11/19/wall-streets-hottest-loan-product-borrowing-agains.aspx