Single Point of View

Single Point of View is our way to occasionally share planning ideas relating to personal finance. Our goal is to pass along concepts that you may not be exposed to on a daily basis.

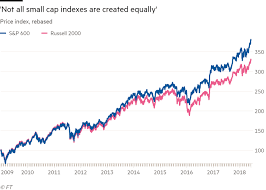

Even With Index Funds, You Need to Know What You Own

At Single Point we believe that index-tracking funds offer the best outcomes over high-cost stock-picking funds. As the number of trackable indexes has grown over the years – especially beyond the core Large Cap S&P500 Index - we spend a great deal of time identifying the best index to track the complimentary or ‘satellite’ asset classes. In the Small Cap [...]

SPP Featured in Investment News

Excited to see that our conflict free model is gaining some national recognition. Thought you might enjoy the article below: At this firm, flat fees are about offering conflict-free advice At Boston firm Single Point Partners, adviser Seth Corkin says clients don't have to worry about what's motivating advisers' recommendations By Jeff Benjamin | June 9, 2018 - 6:00 am EST [...]

Tax Law Changes Impact on Your Stock Options

Four months into 2018 and many are still digesting the changes to the tax code resulting from the Tax Cuts & Jobs Act (TCJA). To date, there’s been a lot of buzz about the impact on business owners and the limit of state and local tax deductions. However, the bill also has major implications for those participating in their [...]

Announcing Our New Website

Looking at pictures will really put time into perspective. 6 years ago we launched Single Point Partners. I think the picture that helps me realize how time has passed the most is of my daughter Annemarie sitting at my “desk” in 2012 contrasted with her in my office today. Like Annemarie, Single Point has “grown up” over our first six [...]

A ‘Full Trade War’ on the Horizon?

A full-blown trade war, though unlikely, would be very damaging to equities. What happened? President Trump announced that he plans to impose a 25% tariff on imported steel and a 10% tariff on imported aluminum. Why does it matter? A ‘full trade war’ is not something we have seen since the Smoot-Hawley Tariff Act of 1930 which made the Great [...]

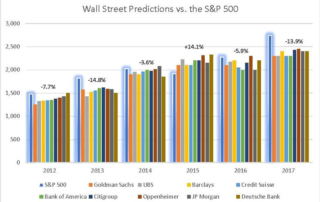

Market Predictions vs. Reality

Every year the big Wall Street banks publish their year-end targets for the S&P500. Think of these as a gauge of Wall Street’s collective wisdom. Their well-paid researchers crunch a ton of market and economic data. I will save you the suspense – their forecasting ability would be laughable, if it wasn’t for the fact that millions of families rely [...]