Below is an email to our clients discussing our recent rebalancing of our Target Allocations. We thought it would be helpful to share during this recent market volatility.

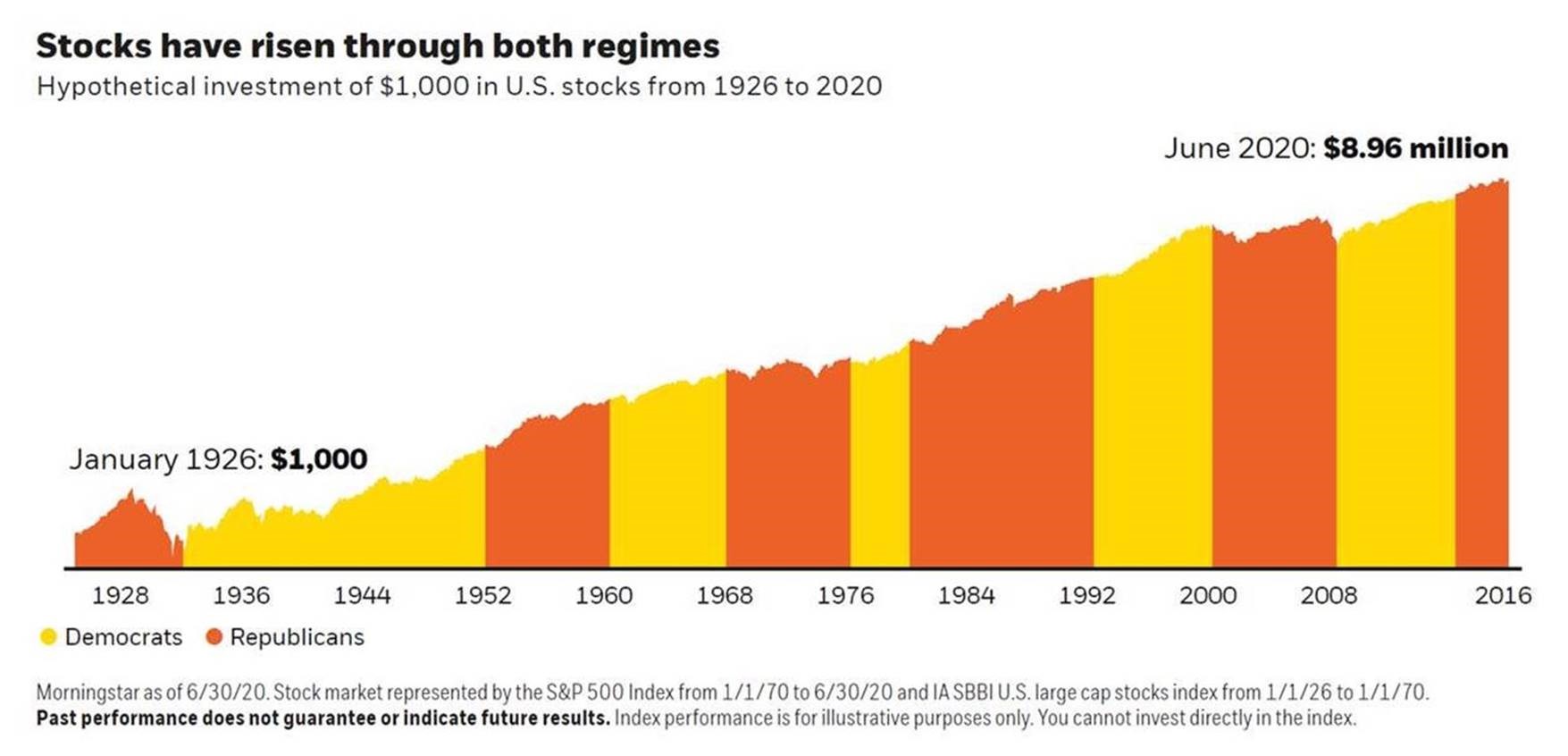

A phrase I always try to keep in mind during times of higher market volatility is “the markets tend to take the stairs up and the elevator down”. For me, this helps keep the long term goals of our clients in perspective when the stock market gets choppy.

Our investment philosophy centers on the belief that the most effective way to achieve your goals is to determine the appropriate level of risk and to consistently rebalance your portfolios to that allocation. Rebalancing involves buying or selling assets in your portfolio to maintain your original desired level of asset allocation. Instead of simply rebalancing the portfolio on a given day each year, we try to choose times throughout the year when certain asset classes have drifted from the target allocation in a meaningful way (5-10%). This helps us ensure that we are sticking to the age old method of “buy low and sell high”.

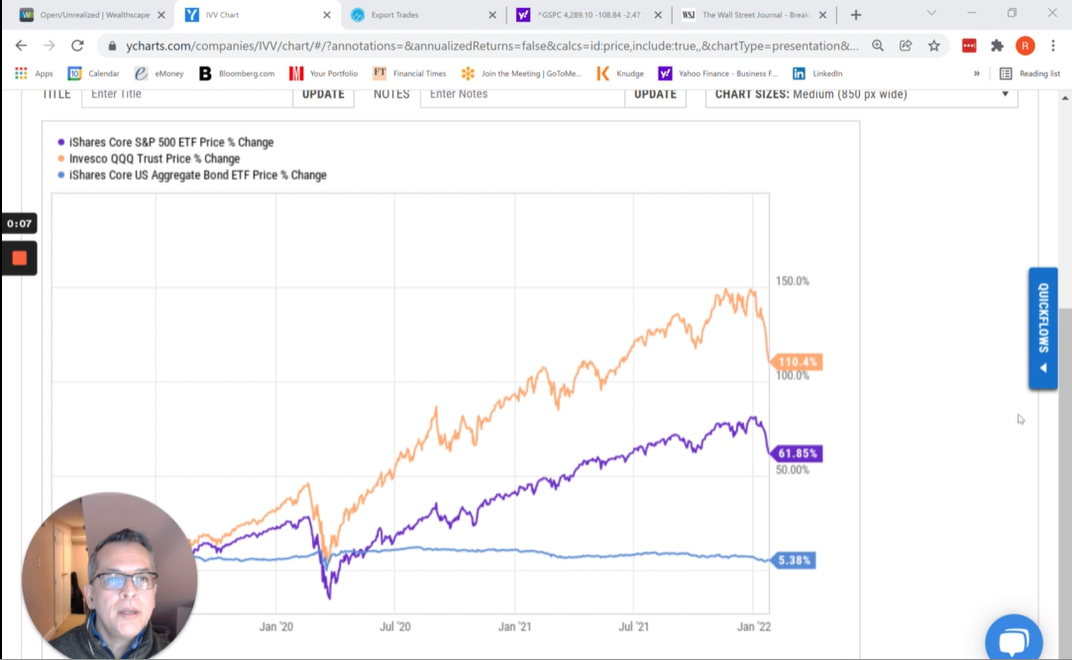

The majority of our clients tend to describe themselves as more conservative, essentially, willing to give up some of the upside to protect more on the downside. Because of this, we will from time to time position our portfolios in a slightly more conservative manner (as we did during the summer). Our thought process at the time was that the market had been on a relatively straight upward path with very little volatility. We felt there was an opportunity for some pullback in the markets that would allow us to rebalance the accounts to the appropriate long term allocation, this allowed us to sell a portion of the better performing assets in the accounts while they were up in value and be slightly more defensively positioned in your accounts for the past few months.

Even with the recent slide in the stock market, Large Cap US Stocks are still up around 3% Year To Date, and 12% over the last 12 month. Other asset classes have not performed as well, with the International Index down 6% YTD and Small Company Stocks down 7.5% YTD. This recent market sell-off, combined with our already defensively positioned portfolios, has moved our actual allocation to a relatively significant underweight to risk assets. For example, if your target allocation is 60% Risk (aka Equities or Stocks)/40% Stable (aka Fixed Income or Bonds) your current position is closer to 50/50. We look at this as an appropriate time to buy back up to 60% Risk in those portfolios.

Another aspect we monitor is the performance of different sectors of the economy. In our portfolios this year we have owned Technology (+7.5% YTD), Healthcare (+11.5% YTD) and Real Estate (+14.5% YTD) as over-weights to our Large Cap US Index position (+3% YTD). This has certainly benefited our Large Cap US component of the portfolio. We will use this opportunity to rebalance those positions, along with slightly reducing our exposure to Technology and International in our Targets. We will add a small allocation to a new position in a sector that has been down 6% YTD, US Industrials (to give you a sense some of the top holdings in this index are GE, Union Pacific, UPS, Raytheon).

We will continue to implement most of these changes by using low-cost indexes of Exchange Traded Funds. If you have self-directed accounts (401k plans, etc.) that may have drifted away from your target allocation you may want to take this opportunity to review them and rebalance as well.

We want to be clear, these moves are not a bullish stance on the markets. They are in our minds simply sticking to our long term philosophy of rebalancing portfolios to their appropriate allocations. We could certainly continue to see short term volatility in the stock market. In general, we think trying to predict the short term movements of the markets is a losing game long term. Knowing the appropriate level of risk based on your goals & time horizons, and remaining disciplined to our approach is the best way for us to help you achieve your long term objectives.