We could not be more excited to announce the addition of Mary Casady to the SPP team as our newest Planning Analyst. As our team continues to grow, I am encouraged by the various paths we have all taken to arrive at Single Point. I know these unique experiences help us approach issues from various angles, which is an immense benefit to our clients as we partner with you in making great financial decisions. Mary’s most recent path was in the Administration of Governor Baker. It is here that Rene was first introduced to Mary via their shared time on the Board of MassVentures. In just her first two weeks at SPP, we can see why Rene was so enthusiastic about the idea of Mary joining the team. We are quickly seeing firsthand her impressive combination of intelligence, work ethic, and great sense of humor.

You can read Mary’s story below to learn a little about what makes her tick. I know you will all enjoy getting to know Mary over the coming months.

While my career spans nearly a decade’s worth of experience supporting financial advisors, I always struggled with the idea of getting on the planning path myself.

Many aspects of financial planning seemed like things I would find enjoyable in my career. I truly enjoy getting to know people and finding out what matters most to them. As an avid reader, I love staying on top of current events and learning more about how they impact financial markets.

However, when I looked at the traditional commission model, I worried that it just didn’t align with my values and how I wanted to work with clients.

Luckily, not only did I discover the world of fee-only planning, but I discovered Single Point Partners. The unique model for setting fees based on net-worth, rather than as a percent of Assets Under Management (‘AUM’), and the emphasis the team has on transparency had me hooked. I am so grateful Rene and I crossed paths on the MassVentures board and I am thrilled to join the team as a Planning Analyst.

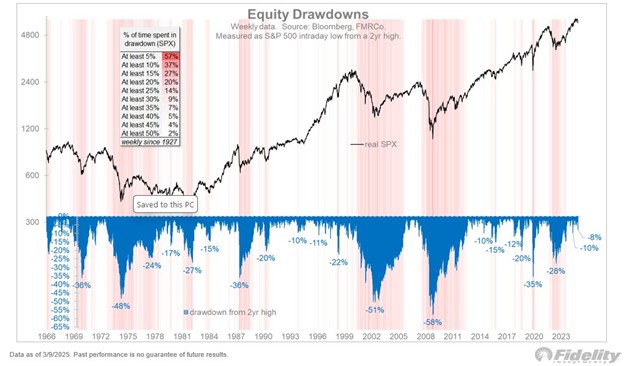

Prior to coming to Single Point, I worked for a variety of financial services companies, both here in Boston and in New York City. Interestingly, my career began during one of the most turbulent times in American financial history.

In the summer of 2008, with my economics degree from Brandeis University in hand, I moved to New York City, to work for French insurance company, AXA Equitable. With our offices located in midtown Manhattan, I found myself at the epicenter of the financial crisis. Witnessing Lehman employees walk out of their offices one final time, past rows of TV news crews is something I don’t think I’ll ever forget. Our experiences play such an important role in our views about our finances and this one was no different for me.

A few years later, I returned to Brandeis University for my MBA. During this time, I got really into salary negotiation. Like, really into it. I often joked that my epitaph would probably have “did you negotiate?” carved in to it.

Now, let me explain something here. I did not start off negotiating my salary with my first few jobs out of college. The common belief that talking about money is rude coupled with the feeling that I was just lucky to have a job, especially after 2008, led me to initially ignore the whole concept entirely. The thought of it made me very uncomfortable.

Once I learned that many employers expect salary negotiations, a flip switched for me. I dove head first into the research and read everything I could find about it. I went from being completely intimidated to leading workshops on the subject. It even got to the point that friends of friends reached out for help, without even having met me first.

I bring up my experience in salary negotiation because it feels like a natural step toward a career in financial planning. Both topics require talking about money, which to many of us can feel uncomfortable and intimidating. This sensitive topic requires establishing a trusting environment and highlights the importance of culture to a financial planning firm.

The key reason I chose Single Point is because of the culture Shaun and the team represent. The emphasis on transparency and education not only made me feel at ease during the interview process but also are key values we bring to working with our clients.

Reflecting on my time in this industry, I think we’re at an exciting inflection point. Consumers are demanding more transparency in all aspects of their lives and financial planning feels like the next frontier. I believe Single Point is leading the way on this and it’s not because of anticipated industry trends, but because it is truly the best way to work with clients.