Four months into 2018 and many are still digesting the changes to the tax code resulting from the Tax Cuts & Jobs Act (TCJA). To date, there’s been a lot of buzz about the impact on business owners and the limit of state and local tax deductions. However, the bill also has major implications for those participating in their company equity incentive plans. While the bill did not overtly change the tax treatment of company equity incentives, there were changes to the tax code that directly impact planning opportunities for those with stock options.

Bottom Line:

Given that far fewer taxpayers will be subject to the AMT under the new tax codes, many taxpayers will have an opportunity to exercise their ISOs tax-free!

TCJA Changes to AMT:

Complete repeal of the AMT was discussed as part of the TCJA; however, instead of eliminating the AMT there were several key changes made to the tax code that directly impact the AMT calculation.

We won’t bore you with the details on the changes, but the result is that it will be far more difficult for a taxpayer to fall into the AMT.

To give you a high-level sense: in the past a married couple making over $200,000 a year in a high tax state has likely flirted with the AMT. Under the new tax law your income would need to be substantially higher to be impacted.

To put it in perspective, according to the Tax Policy Center the AMT impacted about 5.25MM filers in 2017 and is expected to impact only 200,000 filers in 2018.

Why AMT Matters for Stock Options:

Before diving deeper into the tax law changes, we need to make the distinction between the two types of stock options – Nonqualified Stock Options (NQSOs) and Incentive Stock Options (ISOs).

- NQSOs do not qualify for special tax treatment and can be granted to employees, board members, and more. Shares are granted at an explicit strike price. When the stock is exercised (purchased by the employee), the employee is subject to ordinary income and employment taxes on the spread (the difference between the FMV of the stock and the strike price). Should the employee hold the options after exercising, the difference between the FMV at date of exercise vs. the FMV at date of future sale is a capital gain or loss.

Due to the income tax component, holding NQSOs past exercise can be very expensive which is why many choose to exercise and sell the shares at the same time.

- ISOs are tax advantaged options that are only available to employees. Like NQSOs, shares are granted at an explicit strike price; however, when the stock is exercised the employee does not recognize any regular tax. Instead, the spread between the current FMV and strike price is included as income for the purposes of calculating the Alternative Minimum Tax (AMT). If the shares are held for a sufficient amount of time to be treated as “qualified”, then the future sale will be treated as a capital gain instead of ordinary income.

Taxpayers who are not subject to the AMT could essentially exercise their options tax-free, while those subject to the AMT (or pushed into it by an exercise of ISOs) would incur an incremental tax bill.

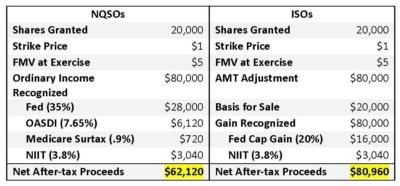

The chart below compares NQSOs with ISOs for a taxpayer who is not subject to the AMT. Let’s assume this taxpayer both exercises and later sells at $5/share. The taxpayer is subject to the 35% rate on ordinary income and 20% on capital gains. The taxpayer is also subject to Social Security taxes (7.65%), Medicare Surtax (.9%), and the Net Investment Income Tax (3.8%).

‘The Catch’ with ISOs:

Given how the AMT is calculated, exercising ISOs was a common way for employees to push themselves into owing the AMT.

For many taxpayers, the incremental AMT tax cost coupled with the cost to exercise shares (amount of shares multiplied by strike price) made exercising and holding options prohibitively expensive.

The Result for ISOs:

Given that far fewer taxpayers will be subject to the AMT under the new tax codes, many taxpayers will have an opportunity to exercise their ISOs tax-free!

For those who still find themselves subject to or on the verge of the AMT, all hope is not lost. Tax planning strategies such as splitting ISO exercises over multiple years or bunching certain deductions (i.e. – charitable gifts) can still yield a major benefit.