For part 3 of our series on the impact of the election on your finances, let’s tackle the potential impact on estate taxes and the planning you can consider.

Right now, the Federal estate exemption is as high as it’s ever been ($11.58MM per person!) with the exception of 2010 where the estate tax was fully waived for a year (sometimes referred to “Steinbrenner year” since this is the year George Steinbrenner passed, avoiding millions and millions of estate taxes! Good planning, right?).

With the exemption so high, the Tax Policy Center estimates that in 2020 only ~4,100 estate tax returns will be filed and, of those, only ~1,900 will be taxable. That’s less than .1% of the 2.8 million people expected to die this year! With such a small amount of people potentially exposed to the estate tax, this seems like one area that could certainly be in the crosshairs for change.

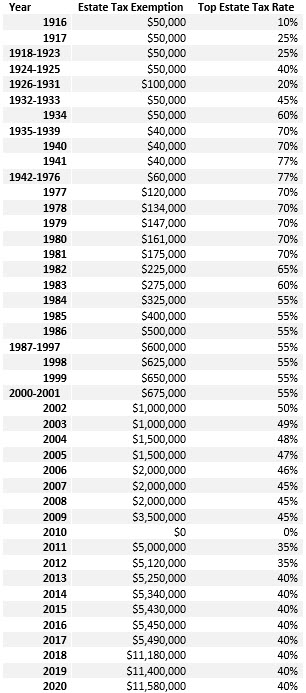

Below is a historic chart of the Federal exemption and the corresponding top estate tax brackets:

Biden has said that he would want to take the exemption back down to the pre-TCJA levels (~$5MM exemption per person). As of now, gifts made up to the current exemption will not be clawed back down the road in the event the exemption is lowered in the future. This essentially means if you give away the full $11.58MM this year, and they later reduce the estate exemption to $1MM, then the incremental $10.58MM transferred will permanently avoid estate taxes! Depending on the state you live in, there could be additional state benefits for transferring significant chunks of money out of your estate (hello to my fellow Massachusetts residents who are included in that category!).

A potentially bigger item is that Biden would like to eliminate the step-up in basis. For context, if someone passes away with an appreciated asset then the cost-basis would be adjusted to the date of death value. For example, let’s say you own $1MM worth of Google stock and only paid $100k for it. Under the current rules, the heirs would receive a full step-up in basis to $1MM, eliminating $900k in taxable gains! Biden would like to eliminate the step-up in basis so that either the decedent during their lifetime or their heirs would still be on the hook to pay taxes on the $900k of appreciation. This would make multi-generational income tax planning extremely valuable for those individuals with appreciated assets that have let the tax tail wag the investment dog for too long… After all, good tax planning is not just minimizing the taxes paid in a given year – it’s minimizing taxes over a lifetime!