We help people analyze decisions that impact their financial future everyday. Often times, the analysis that goes into making a financial decision is focused on what will have the most positive impact on your bottom line. However, we are often reminded that the choice that may have the “best result” from a financial standpoint is not necessarily the one that is the best choice for you.

The reason is that there is value in peace of mind. This value, and the choices we apply it to, is different for everyone.

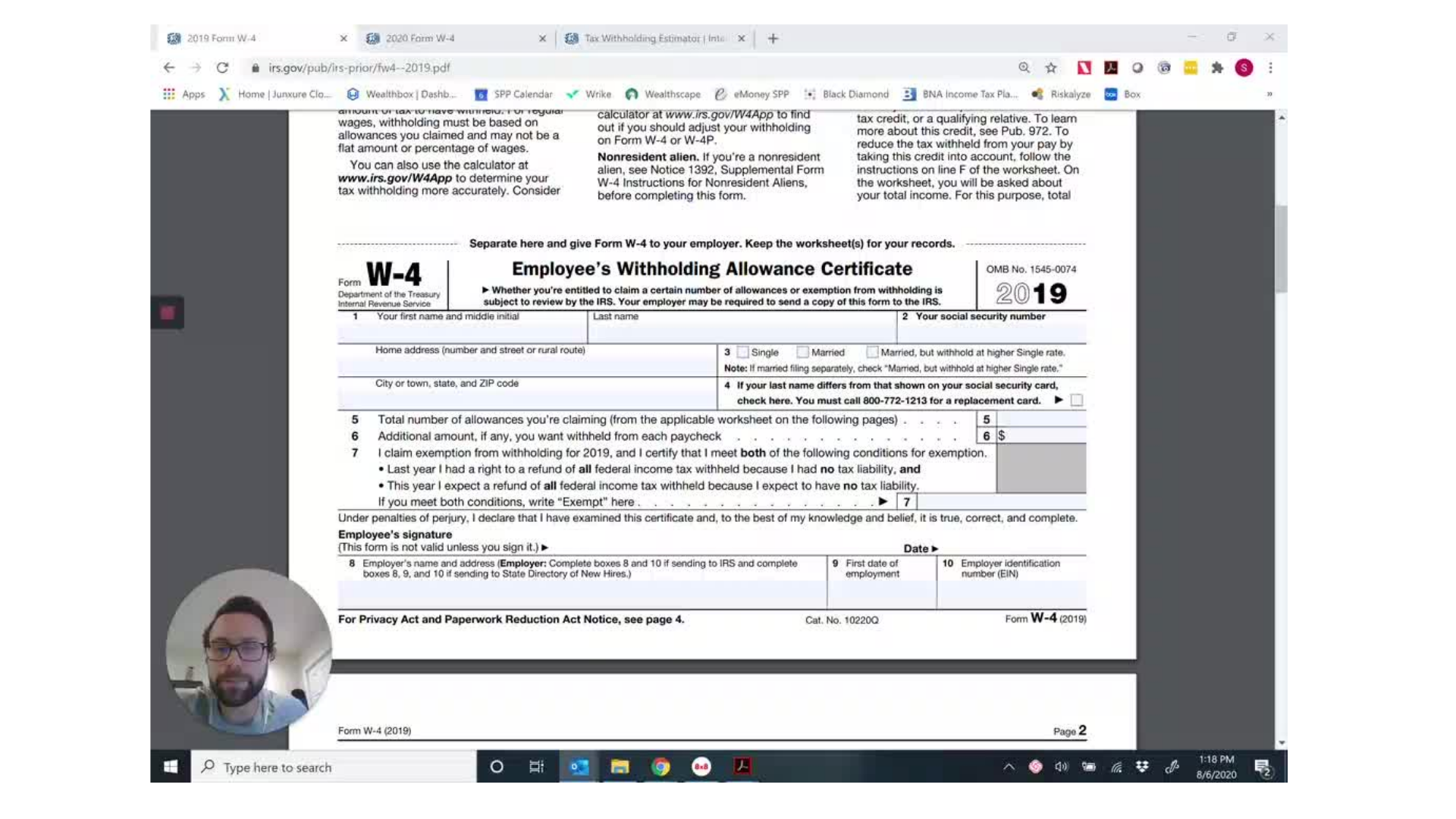

A simple example of this is paying down low interest debt, say a mortgage. With a long time horizon one could make a strong argument that aggressively eliminating a mortgage at 3% interest is not the best use of those dollars. That a better return can be had by choosing some other investment and allocating towards it. In reality, the lack of debt (and accompanying extra cash flow due to lack of debt payments) in the future allows some people the freedom to make better choices with their other assets. This could mean the willingness to take additional risk elsewhere. Or it could simply give you the freedom to spend the assets you have on the things that make you happy.

If a “Peace of Mind” decision is one that could lead you down a path that will not allow you to achieve your goals, it is our job to help you understand that and maybe make a different choice. However, if the “Peace of Mind” decision simply means you may end up with less wealth at the end of the day, it often can be the right choice. Especially if it helps you make a better choice in another area.