It’s been just over 2 years since I made this post. The sentiment of the video and my remarks are as true today. It was circled back to me from a great friend and client today, so I thought I would re-share it with all of you….

Thank you John Oliver for explaining the problems in the financial advice industry in a way that I never could (with a lot of swears and humor).

That bowl of soup explains better than I ever could exactly why we act as fiduciaries for our clients.

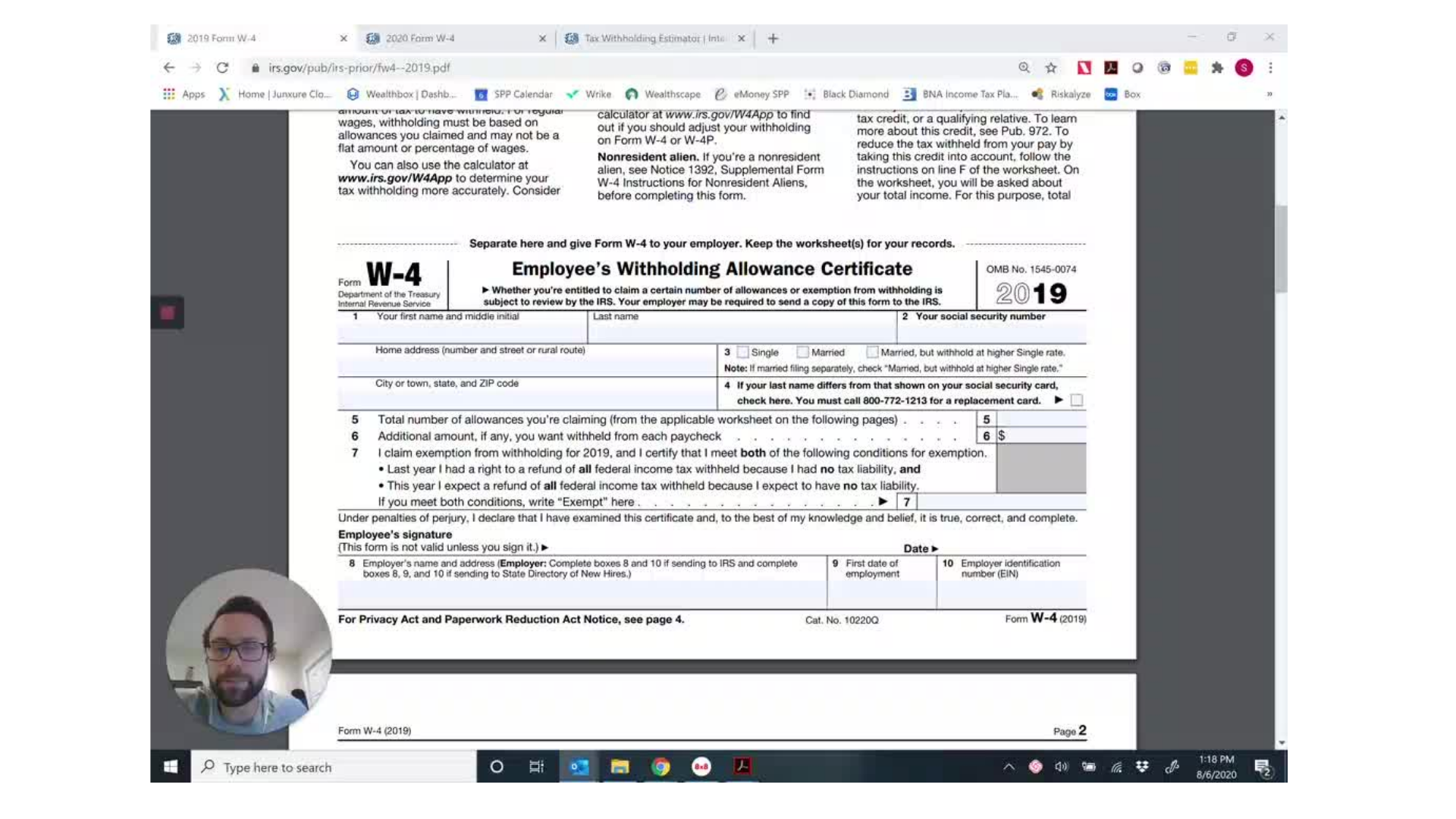

Oliver outlines the reality of the impact of fees (most of which are hidden). This is exactly why we have moved to a flat fee model for our Personal CFO relationships. We want you to know what you pay (in dollars) for the advice/guidance we provide.

He discussed the new Department of Labor ruling which I wrote about in a recent blog post. Here are my ‘boring’ thoughts:

When the lobbyist for the big financial institutions are fighting this hard against a change, you know it is for a reason (hint: it probably isn’t because they truly believe it is best for you). The argument that the lower to middle income people will be hurt by this the most doesn’t resonate with me. The industry will, and should adapt, to pricing structures that work for a business model that supports providing advice to people while being held to a simple standard of it being in their best interest.

I love seeing these issues come to light.

Awesome reminder and John Oliver is funny. You have definitely taught us about the value of reducing fees. Thank you!!