Late last night the Senate passed an economic stimulus package which is expected to be passed by the House and voted into law. Most importantly, we want to focus this update on areas that will be helpful to those most impacted. We’ve been reading through the broad array of information in the 883 page bill! Below we’ve highlighted some updates to the previous resources blogs, as the information and resources are changing day by day.

We’ve also highlighted some of the initial features of the new federal bill that may have an impact on our planning with you for the balance of the year.

There is a lot to digest here, and much of this will require additional guidance from the government on the details of implementation. We at least wanted to draw your attention to some of the provisions we’ve seen so far. Rest assured, if we feel there are opportunities to adjust our planning for our clients based on these new rules, we will be proactively reaching out to you in the coming days & weeks.

- Unemployment Benefits:

- The federal government will supplement state unemployment benefits by providing an additional $600/week on top of state benefits for four months while also funding an extension of the state benefits received by up to 13 weeks.

- The bill also extends benefits to those who don’t traditionally qualify for unemployment, namely the self-employed.

- Note: this is being administered via the states and many states have yet to open it up as they are awaiting more guidance from the Feds. Please check your state’s unemployment office website for updates. Here’s the link to MA: https://www.mass.gov/unemployment-insurance-ui-online

- Direct payments: Individuals will be eligible for a $1,200 payment ($2,400 for joint tax flyers + $500 per qualifying child).

- This will be income driven. Phaseouts for eligibility based on Adjusted Gross Income:

- Joint Filers: $150,000-$198,000

- Filing Head of Household: $112,500-$136,500

- Individual: $75,000-$99,000

- What income will they use?

- Based on 2019 tax return AGI if you have filed already

- If you haven’t filed 2019, based on 2018 AGI

- So, if 2019 income was lower and would pull you into the eligibility range, it’s an incentive to file your 2019 return instead of delaying to 7/15..

- What do you need to do?

- Apparently, there should be little to no administrative needs on your part. The plan is to send the funds by check to your address from the return, or to return to the bank account your refund was sent to (obviously there are potential issues with this if you closed an account). If you’ve moved you might want to try updating your address with the IRS: https://www.irs.gov/faqs/irs-procedures/address-changes

- This will be income driven. Phaseouts for eligibility based on Adjusted Gross Income:

- Protections against foreclosures & evictions for renters: The bill states that anyone facing a financial hardship from coronavirus shall be given a forbearance on a federally backed mortgage loan of up to 60 days, which can be extended for four periods of 30 days each. The legislation says that servicers of federally backed mortgage loans may not begin the foreclosure process for 60 days from March 18. During this time no fees, penalties or additional interest can be charged. For landlords with federally backed mortgage loans it provides protection to their tenants, they would not be allowed to evict solely for failure to pay rent for a 120-day period, and they may not charge fees or penalties to tenants for failing to pay rent.

- Student Loan Relief: Student loan payments are suspended for Federal loans through 9/30/2020, no interest will accrue during this time.

Payment & interest suspension will be automatic so no action is required to benefit from this.Update 3.27 Now hearing you will need to reach out to your loan servicers to stop payments. Note: the bill does not provide relief for private loans, nor for any FFEL or Perkins Federal loans that are not held by the US Dept of Education. - Small Business Lending: UPDATE 4.2.2020 (Use the link to this new blog post with more detailed/updated information on small biz resources).

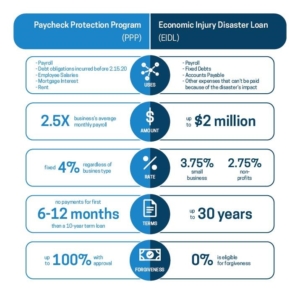

We’ve updated the information from below as the program MA was originally pointing businesses to for loans is now being directed to the US Small Business Admin Economic Disaster Loan program (EIDL). The new place to go for information, assistance and applications is here. Another program is the Paycheck Protection Program which is offering small businesses S.B.A.-backed loans to pay for basic expenses. They would not have to repay portions that were spent on paying employees, a mortgage, rent or utilities. The banks lending the money would be reimbursed for those portions by the Treasury Department.

- Taxes: While the Federal tax filing deadline has moved to July 15th, not all states have yet announced a matching move (including MA). Which means as of now you still need to file your MA return (or file an extension with MA) by 4/15. Hopeful extensions from more states will be announced soon. Click here for a list of where all states stand to check where your’s stands. UPDATE 3.27.2020: MA has also extended tax filing deadline to July 15th!

Below are a few areas we wanted to highlight in the new federal stimulus bill, stay tuned here as there will be more to follow (To SPP clients: we’ll be learning more about these and how they impact each of you. We will reach out directly if there is any time sensitive matters for you to address):

-

- Charitable Contributions: For those who are no longer itemizing deductions, you will be allowed an above the line deduction of up to $300 for charitable cash contributions.

- Healthcare: Covid-19 tests are required to be covered by your insurance, same will apply to a vaccine if that becomes available.

- Business Owners: There is some payroll tax relief for businesses and business owners who are impacted and for those who don’t qualify there is deferment of payroll taxes.

- Required Minimum Distributions from IRAs, 401(k), 403(b) and 457 (b) plans have been waived for 2020. If you are fortunate to not need the $$ from your required distribution, you no longer have to take it. We’ll be analyzing this for each impacted client over the coming weeks.

- Early IRA distributions: The 10% penalty can be waived for those who were impacted taking an early distribution from a retirement account. Up to $100,000 and the tax liability can be spread over 3 years. Pretty broad description of what is considered “impacted”.

- 401k loans increased the maximum loan to $100,000 from $50,000 with loan payments delayed for up to a year.

News is moving fast so we wanted to provide a couple of updates to the below (as of 3/20/2020):

- Taxes: The tax filing deadline has now been moved to July 15th to match the change to the payment deadline that was made earlier this week. We encourage you to continue to move forward with your tax prep, especially if we have projected that you will be getting a refund!

- Student Loan Relief: No final news on this but there are now proposals for student loan support. We’ll keep you posted on this.

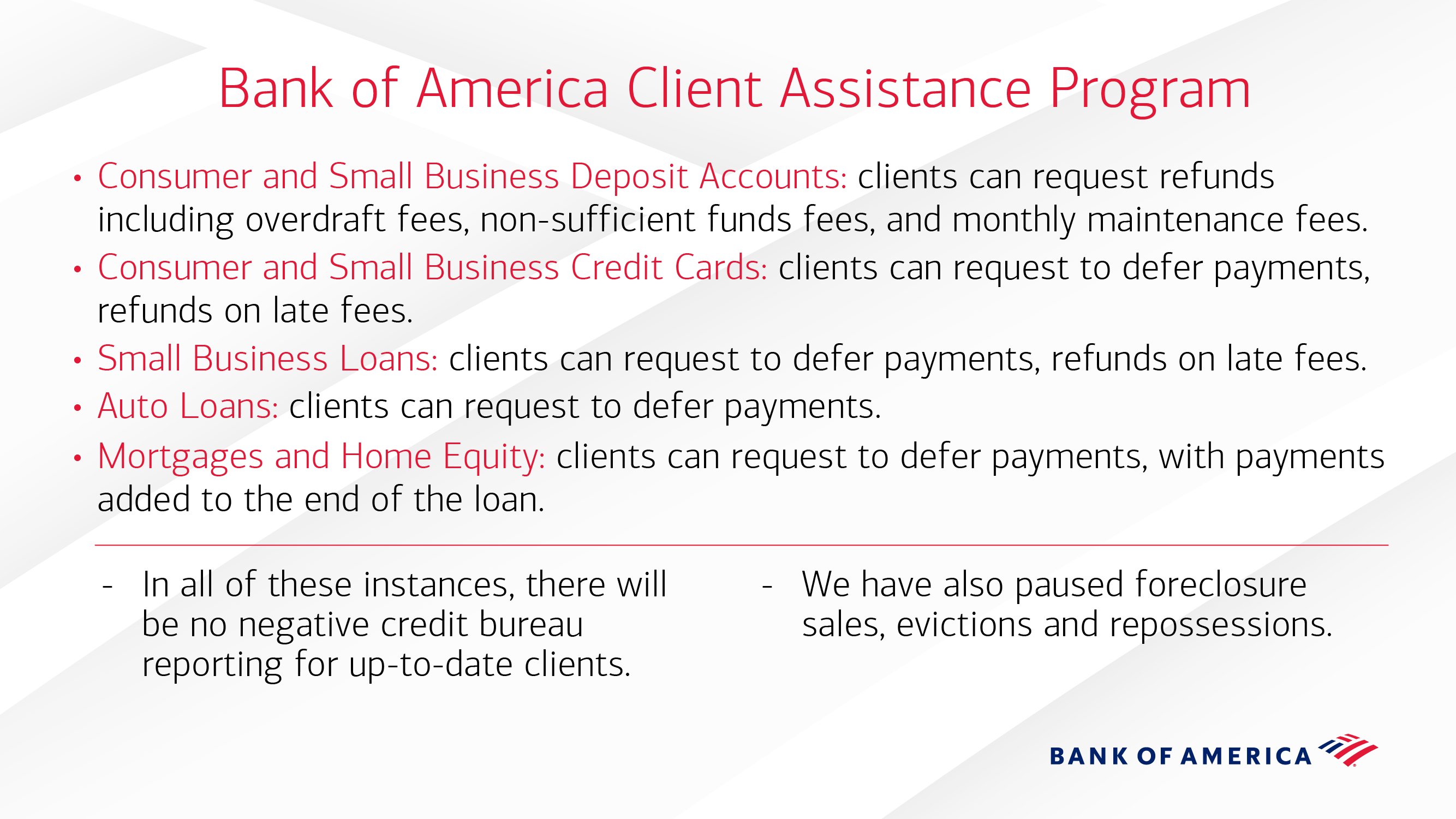

- Mortgage Relief: Keep an eye on news from your bank on this front. Bank of America has already announced that clients can request to defer payments on loans for those affected.

3/18/2020

We know everyone is being inundated with information during this time so we want to keep this note brief and clear up some information we’ve been receiving frequent questions on.

2. Unemployment & Paid Sick Time: Massachusetts has put together an FAQ guide on your rights and employer obligations. They have waived the waiting period for filing a claim for unemployment. More details on this and paid sick time in the link here.

3. Small Business Support: A loan fund has been created to provide relief to Massachusetts businesses that have been affected by COVID-19. A couple of highlights:

-

- Open to Massachusetts-based businesses impacted by the COVID-19 with under 50 full- and part-time employees, including nonprofits

- Negative impact must be verifiable

- Loan amounts up to $75,000

- Loan amount not to exceed 3 months of demonstrated cash operating expenses for the 1st quarter of 2020

- No payments due for first 6 months, then 30-months of principal and interest payments (direct debited)

- Annual interest rate 3%

Find all of the details on the program here (LINK DISABLED AS PROGRAM HAS CHANGED SINCE INITIAL POSTING) along with information on how to apply.

4. Con Artists: Unfortunately, con artists are exploiting public anxiety about the illness to sell fake products, worthless investments and capture personal information to steal identities. Below is some information from EverSafe on steps to take to avoid being a victim. I thought the first one was worth highlighting:

“Be very careful about clicking on links about coronavirus, because the wrong click could download a computer virus.” You can find further information here (yes, I understand the irony in providing a link right after suggesting you be careful of clicking on links!).

While speaking with our clients and revisiting their plans over the past week we’ve been constantly reminded how lucky we are to work with such caring people. As scary & stressful as times like these are, because of these relationships it is also a very rewarding time to be doing this work.

Stay safe & healthy. We’re here (virtually) if you need us.

Shaun Erickson & The SPP Team