Seth is back with another installment of “What’s New(s)?” highlighting the topics that he’s following closely which might have an impact on you, as well as some others that he thinks you might find interesting or fun.

Maura Healey released a $750MM tax reform plan for the state of Massachusetts. Among the notable proposals:

Raising the estate tax threshold from $1MM to $3MM

Reducing the tax on short-term capital gains from 12% to 5%

Increasing an annual child and family tax credit from $240 to $600 per any dependent under 13 or older than 65

Increasing rental deduction cap from $3k to $4k

In particular, the estate tax and short-term capital gains relief would go a long way in making MA more competitive with other states.

The IRS provided clarification around the taxability of certain state refunds (including 62F refunds for MA residents). MOST refunds are not taxable – including if you took the standard deduction or if you itemized deductions but didn’t get a benefit for SALT taxes paid (i.e. you were subject to the $10k SALT tax limit).

Active investors are supposed to outperform passive investors in a down market, right? Well that’s not how it played out in 2022. According to Morningstar only 43% of active funds outperformed their passive peers.

Democratic lawmarkes are taking aim again at several estate planning strategies. Senators, including Elizabeth Warren of MA, are asking the Treasury Dept to curb certain strategies. Some of the strategies in their crosshairs are Grantor Retained Annuity Trusts (GRATs), Intentionally Defective Grantor Trusts (IDGTs), Family Limited Partnerships (FLPs), and more.

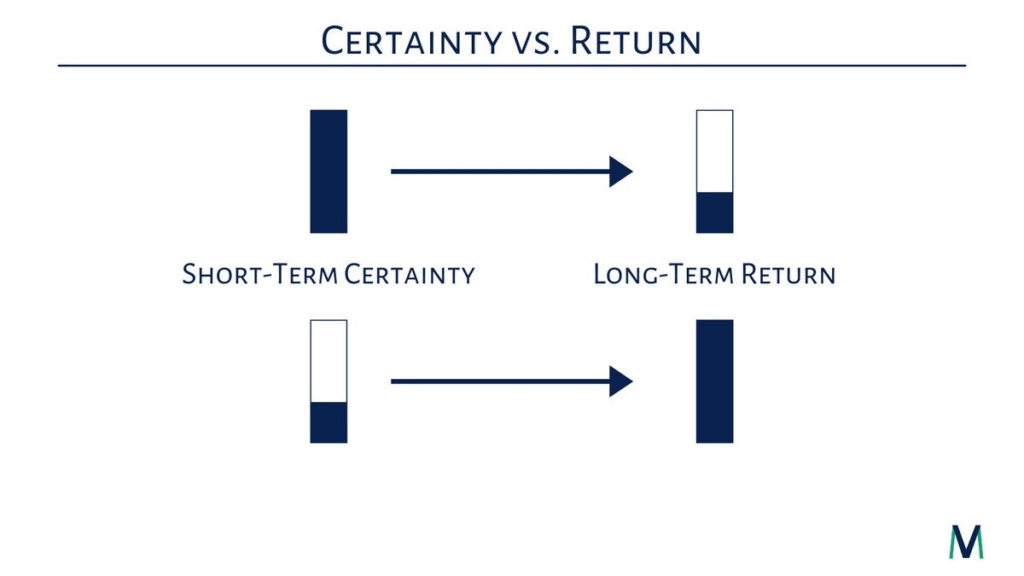

Some sage advice during these volatile times in the markets – “the more certainty you seek from your portfolio in the short-term, the lower your long-term returns will be”. Shout out to Money Visuals (@MVMoneyVisuals) for the quote and graphic.