Shiny Objects, Cocktail Parties, and Short Cuts: Why Is It So Hard to Be an Index Investor?

By: Bob Dockendorff

We’ve all heard the compelling case for an index-tracking investment strategy.

While some investment managers grasp at straws to justify the high fees and underperformance of active management—it’s not often that I hear a genuine unconflicted disagreement with index investing.

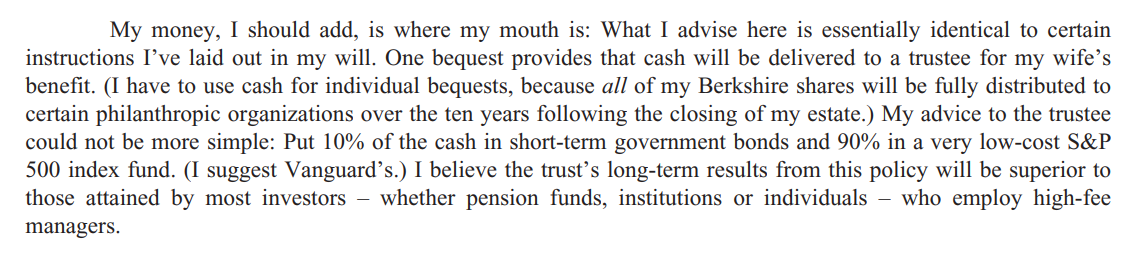

With almost fifty years of index fund performance, the strategy has a proven track record against investment industry’s best minds. In 2008 Warren Buffet challenged hedge fund managers to beat the S&P 500—and they couldn’t. Buffet’s own estate plan directs the trust for his heirs to have a 90% exposure to an S&P 500 index fund.

*Source: 2013 Berkshire Hathaway Annual Report, Page 22

Performance is great, and it requires very little time compared to active management.

Then why do so many people stray back into speculation? If it’s such a simple strategy, why is execution so challenging?

After many conversations with clients, prospects, and other advisors over the years I’ve seen a few behavioral patterns that I’d like to highlight here.

Here are the not-so-good reasons investors deviate from what they know is best.

Shiny Object Syndrome

This one is about addiction to speculation. You can’t invest until you’re truly ready to do so.

“Sure, sure, I totally get that we should index the investments. But I heard about this really good idea…”

I see this all the time. Whether it’s developing the speculator’s mentality (timing the market, picking a stock, making a sector bet), or being sold on a clever investment strategy, investors scrap the boring index strategy for a shot at greatness.

It’s almost like active management is a drug. Some are more prone to addiction than others, and some have been on the drug for much longer than others. This type of “shiny object” behavior often reminds me of when someone is attempting to quit a self-destructive behavior. They know it’s wrong, they don’t want to do it, but they just can’t help themselves.

“I’ve been so good—one cigarette on my birthday won’t hurt.” Boom. Back to smoking.

If you or someone you love struggles with addiction to active management, please contact Single Point Partners. We can help!

The Cocktail Party Effect

No one wants to talk about ETFs at a fancy cocktail party. Real estate, hedge funds, high growth start-ups, private equity, and triple levered commodities ETFs are much sexier and exclusive than a low-cost index tracker that is available to anyone with a few bucks and a smartphone.

It’s a party and everyone’s trying to be cool!

Many clients, otherwise well on their way to building wealth through the consistently investing in index strategies, can hear about their friends’ investments and feel left out. There’s a little FOMO and perhaps even embarrassment after everyone has discussed their niche investment.

“Why doesn’t my advisor suggest things like this?”

Well, it’s not because we don’t know about them, but rather that 99% of the time these investments either aren’t attractive or not worth anyone’s time to find the 1% that are.

Just to be clear here, I’m not talking about investments where investors are ACTIVE participants like small business owners, active real estate development, or equity compensation. Those are all great wealth builders that create windfalls to diversify and grow.

We’re talking “after the windfall” portfolio assets here.

And even if a private investment looks attractive, an advisor wouldn’t recommend more than a tiny sliver of investable net-worth—is that really going to move the needle on a long-term wealth plan?

Additionally, these investments are risky, illiquid, and muddy up your tax reporting. Sounds fun!

Many times, people make these investments with more than financial interest in mind. They like the status of a visible local investment, they want to help a friend’s business, invest alongside other friends, or they were just duped into it. All totally fine so long as you go into the investment eyes wide open (except getting duped).

For me, I like hearing about all the wacky ideas that aren’t really creating wealth fully knowing that the most efficient way to grow a nest egg takes the least intellectual labor….which leads us to…

The “Do-Something” Strategy

We often hear this question: “What Should We Be Doing considering [recent events in current geopolitical/economic climate]?”

And the answer is…absolutely nothing.

It seems very counterintuitive that we should do nothing even though the world seems to materially change every six months. As investment advisors, shouldn’t we be:

- Making sure our core assumptions are still accurate?

- Looking for opportunities?

Index investing is built on the premise that humans are terrible at predicting the future and demands that we don’t even try.

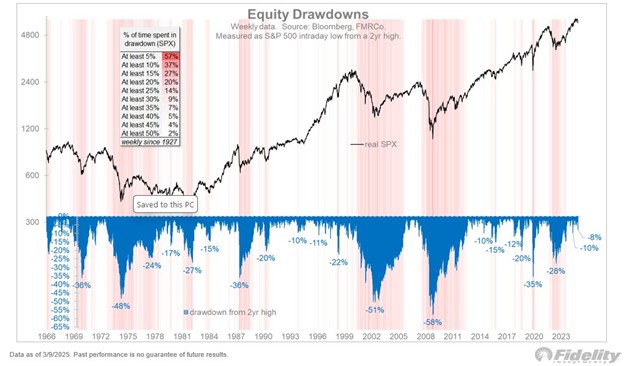

But recent volatility in any area makes us feel like we should change something.

“X event happened, so which sectors will benefit, which will suffer?”

I have no idea. And anyone that tells you they do is lying. They’ll be right sometimes, and wrong many, many more times.

The “do nothing” strategy is like when you’re late driving somewhere and stuck in traffic on the highway. “Should I get off the exit and take backroads? At least we’d be moving.”

We’ve all done it a bunch. Did it save any time? Probably not. Did we have to pay attention to our GPS and take a few wrong turns? Probably.

Index investing may feel like you’re not doing enough. But the key to this strategy is about avoiding mistakes more than “shooting the lights out.”

With that in mind, the next time you get sucked into a short-term news story, hot stock tip, or dinner conversation about exclusive investments—rest easy that your index strategy is the best fit for you, even if your friends aren’t impressed.