In short: fund it and invest it, don’t use it.

Potentially, the best way to use your Health Savings Account (HSA) is to maximize the funding of it, but, instead of using the funds year-by-year to cover your out-of-pocket health care expenses, invest the funds and allow them to grow for the future. The reason this strategy makes sense is the unique tax benefits of HSA’s: tax deductible contributions, tax-free growth & tax-free distributions. Do you know what other types of accounts have all of these long-term features? NONE!

IRAs & 401ks are tax deductible in the year you make the contribution, but you are taxed when you take the money out. Roth IRAs grow tax-free and are tax-free upon distribution, however, you do not get a tax-deduction when you make the contribution. The HSA combines the tax benefits of these two types of accounts.

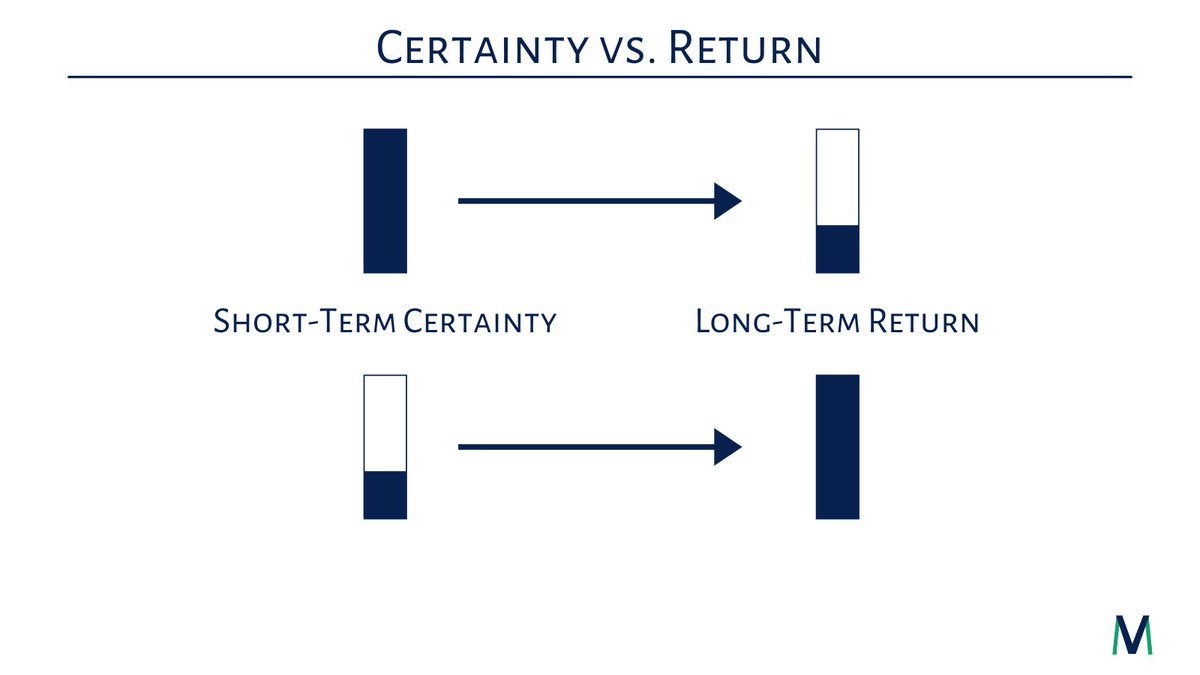

In fact, a good retirement planning budget move for some will be to max your company retirement plan only up to your company match, then, fully fund your HSA (currently $6,750/year for a family; $7,750 if over 55), then go back to contributing more to your company retirement plan. The funds within the HSA can be invested, just like your 401k plan. If you invest them with a long-term horizon (i.e. your retirement years) you can afford to take on risk and generate growth in the account. The goal will be that in retirement you have accumulated an additional bucket of money to be used for healthcare expenses. The benefit is, you won’t be taxed on the money when you use it as long as you utilize the money for a qualified medical expense. Tax-free income in retirement can be a very meaningful planning tool. Of course, it also can be tapped along the way, especially if you were to encounter a year with an out of the ordinary medical expense.

One thing we can count on is that we will have medical expenses in our retirement years. The ability to have an account to use for these expenses, with the powerful and unique tax benefits of an HSA, is a phenomenal planning opportunity. In fact, an HSA can be used to pay for certain Medicare premiums for those 65 and older: Part B, D, or Medicare Advantage (note: you cannot use it for your supplemental plan premiums).

Note: You don’t even have to itemize deductions on Schedule A to be able to deduct the HSA contribution!

Some additional background:

As the health insurance industry has evolved, more of us now have what are referred to as High Deductible Health Plans (HDHP). Essentially, the premise of these plans is that we pay a “lower” annual premium, in exchange for paying more of the cost of our healthcare out of pocket. The higher out of pocket expense tends to come in the form of deductibles. This means you pay 100% of the cost of the service or test until you reach a certain dollar amount, then the insurance company starts paying the cost (often with you owing a small co-payment along the way). Naturally, the funding of the HSA was conceived as a bucket of pre-tax money available to pay that initial deductible along with any ongoing co-payments. However, a better strategy for you may be the one outlined above.

All of the above assumes that from a cash flow standpoint you can afford to pay your out-of-pocket medical expense, well, out of pocket (meaning, directly from your free cash flow, in addition to making a contribution to the HSA). Everyone’s situation is different, which is why we work with you to better understand your budget, cash flow and all of the goals you are trying to save for.

It is important to make the distinction between a Health Savings Account (HSA) and a Flex Spending Account (FSA). The HSA funds are portable, they go with you if you change employers or leave the work force. FSA accounts tend to be a use it or lose it account, where the funds contributed need to be utilized that year.

There are a number of specific rules you will want to be aware of when planning with your HSA. We’ll share some of those with you in a future post. The first step is to understand if you are eligible for these contributions, and if so, to work with your financial planner to develop a strategy that best fits your situation.

Source: sfcfo_archive