The tax law changes at the end of 2017 drastically changed the landscape for deductible expenses – these changes have a major impact on tax optimization and planning strategies going forward.

Back-up – what are deductions?

Taxpayers have two deduction options when filing a return. They can take the standard deduction (a flat amount based on your filing status) OR they can itemize deductions and benefit from things like mortgage interest, charitable contributions, state income taxes, real estate taxes, medical expenses, etc. Whether you itemize or take the standard deduction simply depends on which aggregate deduction is larger!

OK, so what’s changed?

The TCJA imposed many changes to both itemized deductions and the standard deduction – the most relevant changes include the following:

- Itemized deductions

- Mortgage interest paid is only deductible on up to $750k of principal loans (loans taken before 2018 are grandfathered in).

- State and local tax deductions were fully deductible under the old tax regime. Now taxpayers are only able to deduct up to $10k of these expenses. This ‘cap’ on state and local tax deductions has major implications for those who pay high real estate taxes and live in states with high income taxes.

- Miscellaneous itemized deductions are no longer deductible (include unreimbursed business expenses, investment advisory fees, tax prep fees, etc.).

- Standard deduction

- The standard deduction available to taxpayers increased from $6,350 to $12,700 for single taxpayers and from $12,000 to $24,000 for those filing joint returns.

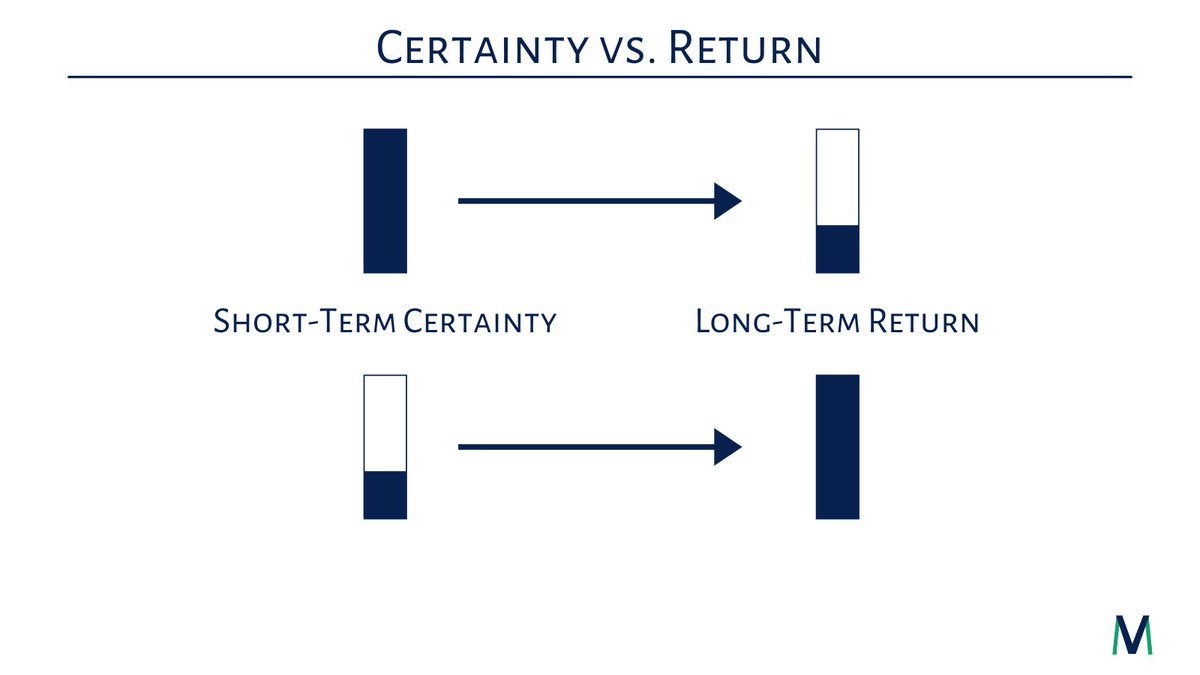

Bottomline – between the changes to expenses eligible to be itemized deductions and the increase in the standard deduction, there is now a higher hurdle to itemize deductions and far less taxpayers will itemize on an annual basis going forward. This means that you may not get a tax benefit from previously deductible expenses like mortgage interest paid and charitable contributions!

Is there anything I can do to ensure I still get a benefit for my charitable contributions???

Absolutely! Taxpayers will need to do proactive tax planning throughout the year to understand how close they are to the “standard deduction hurdle”. Here are some strategies to evaluate with your financial and tax advisors:

- Clumping charitable contributions – rather than contributing cash to charities each year, consider establishing a Donor Advised Fund (some may also consider a Private Foundation, but there are many more administrative burdens with these entities). Donor Advised Funds (DAFs) have several major benefits:

- They are tax-advantaged entities – you get a deduction when you initially contribute to the DAF, then you can control when and how money gets disbursed to charities over time.

- DAFs have investment options within the plans – if you contribute several years’ worth of contributions you can invest the money and grow you’re the fund for future charitable contributions.

- These vehicles can accept cash OR appreciated securities for those who want to eliminate the tax burden associated with selling a security.

Taxpayers stand to benefit from ‘frontloading’ their charitable contributions to a DAF. For example, instead of contributing $5k in cash to charities each year, you can contribute $25k to a DAF and get the full tax benefit in the year you contribute. Then you can decide how that $25k gets disbursed to charities over multiple years.

- Qualified Charitable Distributions (QCDs) – QCDs can be extremely beneficial for those who are taking required minimum distributions from an IRA. A QCD is a direct transfer of funds from an IRA to a qualified charity. QCDs are not includable in your gross income and you do not receive a charitable deduction on Schedule A – it’s as if the distribution avoids any tax implications. Other benefits of a QCD include:

- Goes towards satisfying required minimum distributions

- Avoids being included in a taxpayers Adjusted Gross Income which can impact:

- Deductibility of certain itemized deductions (such as medical expenses)

- The taxability of your Social Security benefits

- Medicare annual Part B premiums and Part D surcharges

- State income tax calculations

It’s important to note that a QCD must go directly to a charity – it can not be used to fund a DAF or Private Foundation.

The changes to the tax law and the impact on charities is being carefully looked at by Washington. According to the American Enterprise Institute (a Washington think tank), charities are expected to collect $16.3 billion to $17.2 billion less in donations this year as a result of the new tax laws! There are two bills currently proposed in Congress – The Universal Charitable Giving Act and the Charitable Giving Tax Deduction Act – which are aiming to make the deduction for charitable contributions universal regardless of whether a taxpayer itemizes or takes the standard deduction.

Only time will tell whether those bills are successful and, until then, don’t overlook tax planning strategies in order to ensure you get the most bang for your buck!

Happy 4th!