If you have kids who are dependents on your tax return, you may be wondering why you started receiving checks in the mail (or direct deposits to your bank) from the IRS in July.

Earlier this summer, close to 39 million families started receiving advanced monthly child tax credit payments. With these payments came a lot of questions, such as do I qualify? Should I take the payments or opt out? How will these payments impact my taxes in April? Here, I’m going to clarify what you need to know.

Since 2018, the Child Tax Credit has been $2,000 per qualifying dependent. This year, the credit has been expanded as part of the American Rescue Plan, the coronavirus relief package that took effect in March. The plan was designed to give families a little extra breathing room in their budgets for a few months. For the first time in U.S. history, half of that credit is being given to families as an advanced cash payment on a monthly basis from July – December.

Do I Qualify?

The monthly payments are based on your income, specifically your Modified Adjusted Gross Income (“MAGI”). The IRS refers back to your most recently filed tax return to determine income. To take full advantage of the credit, your MAGI must be under $150,000 for those Married Filing Jointly (MFJ) and $75,000 for those filing Single. The credit begins to phase out when income exceeds these thresholds. Income between $150,000 and $400,000 for MFJ filers and income between $75,000 and $200,000 for Single filers gets reduced by $50 for each $1,000 of income, but the credit will not go below $2,000 per child. If MAGI exceeds $400,000 for MFJ filers and $200,000 for Single filers, the phaseout will continue to be reduced by $50 per $1,000 of income and can begin to reduce your credit per child below $2,000. With higher levels of income, you could even be disqualified from the credit altogether.

A few other requirements to qualify:

- You must have provided at least half of the child’s support during the last year and the child must have lived with you for at least half the year

- The child cannot file a joint tax return

How much can I get?

Because the IRS doesn’t know what your 2021 income will be, they use your most recent tax return to determine how old your dependents are and how much of an advance to send you each month. The advance portion is equal to half of the total credit that is paid out over 6 months. When you file your 2021 tax return, you re-calculate your child tax credit and reconcile between what you should receive and what you actually received. More on this below.

The total child tax credit offers up to $3,000 ($250/month for 6 months) for each qualifying dependent child between ages 6 and 17 and up to $3,600 ($300/month for 6 months) for each qualifying dependent child under 6 years old.

This can be confusing, so here’s an example:

Say you are family of 4 with children ages 4 and 6 with $185,000 of Modified Adjusted Gross Income in 2020 and you file taxes jointly. Instead of the full $6,600 ($3,000 for the 6-year old + $3,600 for the 4-year old), you would be eligible to receive a child tax credit of $4,850 because income is over the $150k threshold. Half of this, $2,425, would be sent to you as an advance payment over 6 months, amounting to $404.17 per month from July-December.

How will the payments impact my taxes?

When you file your 2021 taxes, you have the opportunity to true up your total allowable credit – either by claiming the balance or paying back some of the advanced payments if you received more credit than you qualified for. As I mentioned earlier, the advance payments are based off your last filed tax return since the payment were sent out before 2021 income was known. If your financial circumstances have changed since your last tax return was filed, there could be a situation where the IRS overpaid you in the advance payments, necessitating that you true up when you file next year.

For the 2021 child tax credit you have the choice to either claim 100% of the credit when you file your 2021 taxes (due in April 2022) by opting out of the payments, or you can accept 50% of that money as an advance payment and claim the other 50% when you file later on.

The child tax credit can reduce your tax bill on a dollar-for-dollar basis. It is also refundable, meaning that it can reduce your tax bill to zero or even possibly allow you to claim a refund for anything left over.

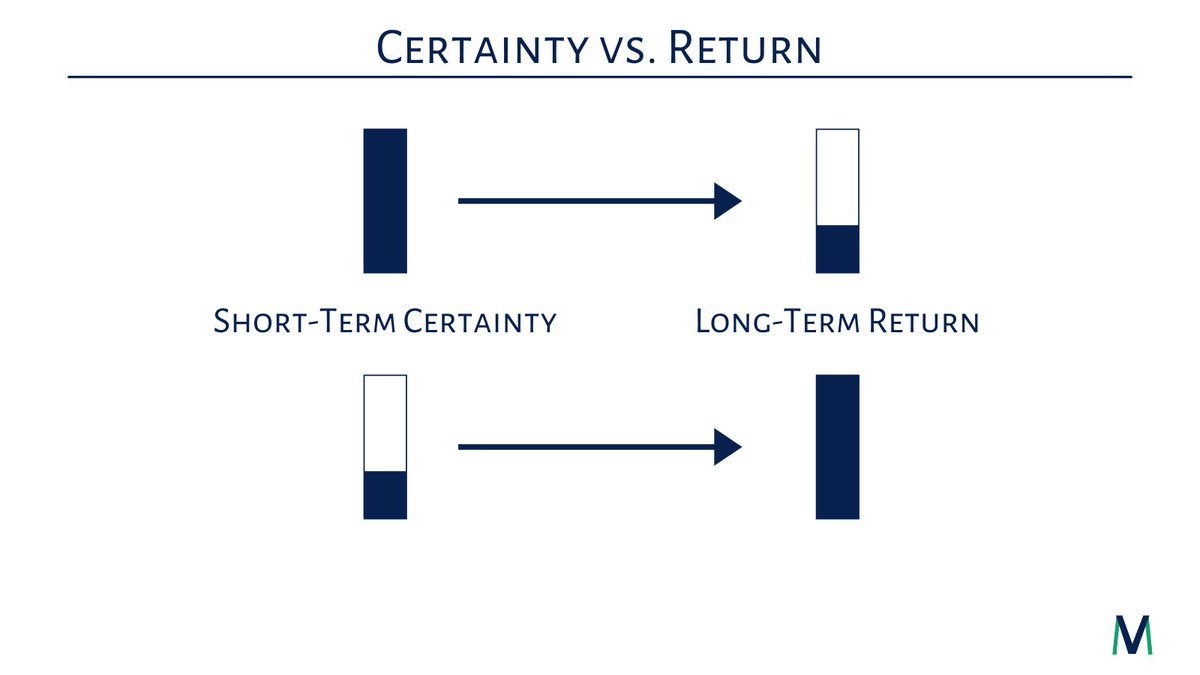

Should I take the payments or opt out?

This is a very common question – and the answer is, it depends. In short, if you are doing tax planning during the year you should feel comfortable keeping the payments. You may owe money come tax time, but it won’t be a surprise because you will be planning ahead.

As described above, a main reason why you would want to opt out is if your income has increased since your last filed return. Since the advanced payments are based off an old return, when you file for 2021, you may no longer qualify for the credit if your income has exceeded the thresholds. If you continue to receive the payments, you could be in a situation where you owe some or all of the amount you received back, and/or increase your taxes owed.

If do you choose to opt out of the payments, the IRS has launched the Child Tax Credit Update Portal to allow families to unenroll. This can only be done online. There are deadlines to opt out each month, so I encourage you to be mindful of those, as well as be prepared for a fairly lengthy process to be authenticated with the IRS before you are able to do so.

We’re always here to answer any questions you may have!