Single Point of View

Single Point of View is our way to occasionally share planning ideas relating to personal finance. Our goal is to pass along concepts that you may not be exposed to on a daily basis.

What’s New(s)? with Seth: May 2021

Seth is back with another installment of "What's New(s)?" highlighting the topics that he’s following closely which might have an impact on you, as well as some others that he thinks you might find interesting or fun. President Biden proposed The American Families Plan which has some major income and estate tax implications. For income taxes, it [...]

Oh, Behave!

Ok, I “borrowed” that headline from a recent CityWire piece I was featured in on financial planners incorporating behavioral finance into their client relationships. Since in an article your comments are limited to quick quotes, I thought I would expand a bit on our beliefs at SPP on the topic. I think a lot of what you commonly see [...]

What’s New(s)? with Seth: April 2021

One quality we've noticed a lot of our clients share is a great curiosity. We're often asked about what we are seeing, reading and paying attention to. So, our own Seth Corkin has started collecting the most interesting articles he's coming across to share them with you in his new blog series, "What's New(s)?". Seth will highlight the topics [...]

Introducing Meghan Dwyer!

What are the qualities that make a great financial planner? Quite frankly, the technical skills needed to analyze and provide impactful advice are mere table stakes. Empathy: It's hard to imagine someone being effective in any "helping-based" career without the ability to understand and share the feelings of others. Curiosity: The instinct to ask great questions, and to dig [...]

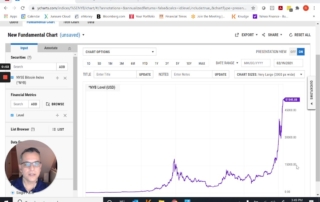

Confessions of a Bitcoin Skeptic

Rene discusses the recent run-up in Bitcoin and SPPs general view on crypto-currency for our clients. He's spent a lot of time researching and learning about crypto, and the role certain investors see for it in portfolios. We'll continue to monitor the role for our clients with an open and inquisitive mind.

Mid-Year Job Change – What happens with my HSA?

Health Savings Accounts (HSAs) are the (not so new) cool account in town! It is like a Roth IRA, but for healthcare expenses. You can open and contribute to an HSA if you are enrolled in an eligible high-deductible health insurance plan. The amount you can contribute is capped each year, but any contributions grow and can be withdrawn [...]