I’m typically skeptical of recognition in our industry. Mainly because I know the behind the scenes of most of these “Top Advisors Award blah blah blah” we see from some industry publications. At first glance the criteria for what makes someone a “top advisor” is never very clear. You’ll notice if you dig a little deeper these are typically a pay-to-play game. How do I know this, because we get offers to be in them every year, all we have to do is write a check.

We prefer for our work to speak for itself and aren’t interested in pay-to-play recognition.

That’s why I was a bit surprised (and curious) when I saw SPP pop up on the recent Citywire’s 50 Growers Across America report.

Today, I finally saw the criteria for this – “Then we look at percentage growth in AUM and percentage growth in employees over the last three years, summed those numbers, and came up with our ‘growth score.’ If a firm grew AUM by $100m over the past three years, it got a leg up in the rankings. From there it was simple to select the winner in each state, and then the runners-up if there were any.” Citywire wasn’t vouching for the abilities of these firms but simply pointing out growth.

In fact, I loved this line from the intro to the report:

“That is to say: The RIAs in this supplement did not ask to be here. They could not compensate us in any way to be considered or to be named. For that matter, they could not do anything to not be named; I’m guessing some of these companies were happily flying under the radar, and won’t appreciate the extra attention.”

It’s cool to see our growth being recognized. The reasons for our growth stem from our unique engagement structure with the families we serve, starting with our fixed-dollar fee model. That’s not to say that our growth is because of the fee approach, but instead what this approach has allowed us to do.

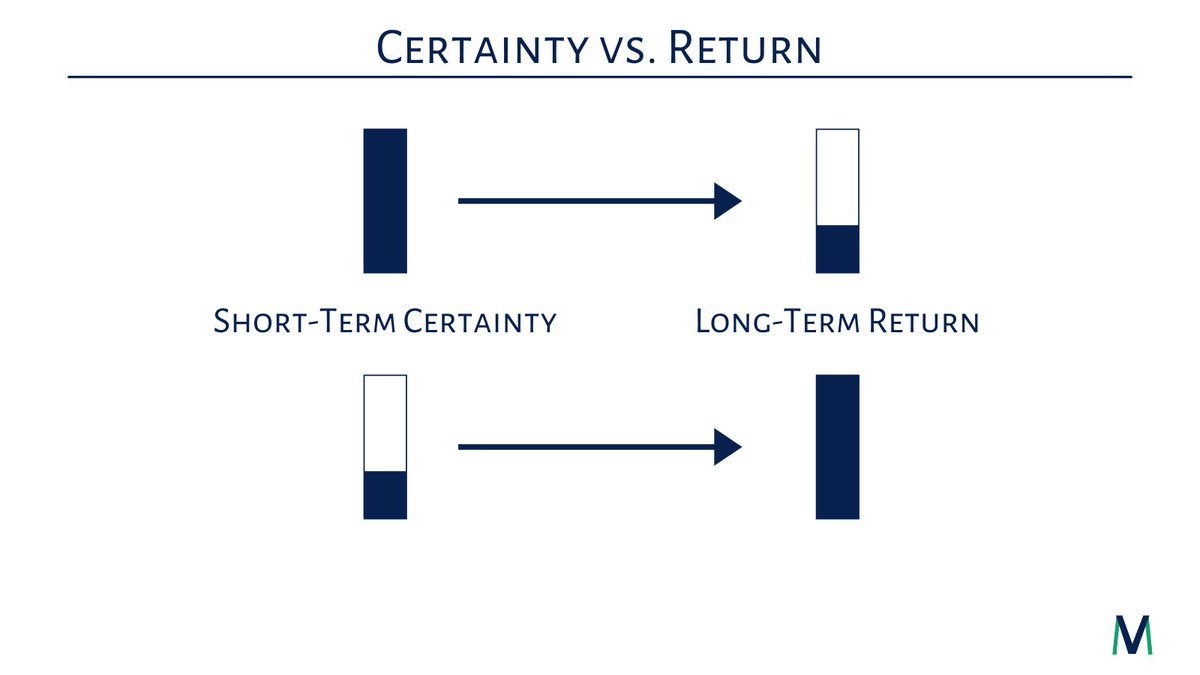

1) Compensation drives behavior and our model was built to empower us to focus on our clients’ top priorities across their entire financial life, without any pressure to gather assets under management.

2) It has allowed SPP to become a desirable location for some extremely talented planners who felt a deep alignment to the Single Point way of working with families. In my mind this is the key to it all, having the talented team to deliver this service is the true driver of our growth. Without this (growing) team, none of this happens.

I want to be clear, this is not a commentary on other firms and how they approach engagements with their clients. This model works for us and the niche of clients who are attracted to the type of service it empowers us to provide. Other firms and their clients may very well be served best under a more traditional asset-under-management (or in some cases even a commission) based model.

We are proud that through SPP we have now given clients a choice that really didn’t exist before. We are thankful for the families who have entrusted us to be their Personal CFO. We are driven to constantly evaluate ways we can improve this service and excited about the future.

Thank You.

PS. Sincere congrats to the growth of Integrated Partners. I know Paul and a number of folks on their team and he has built a firm to be admired.