RJ Takes on Inflation

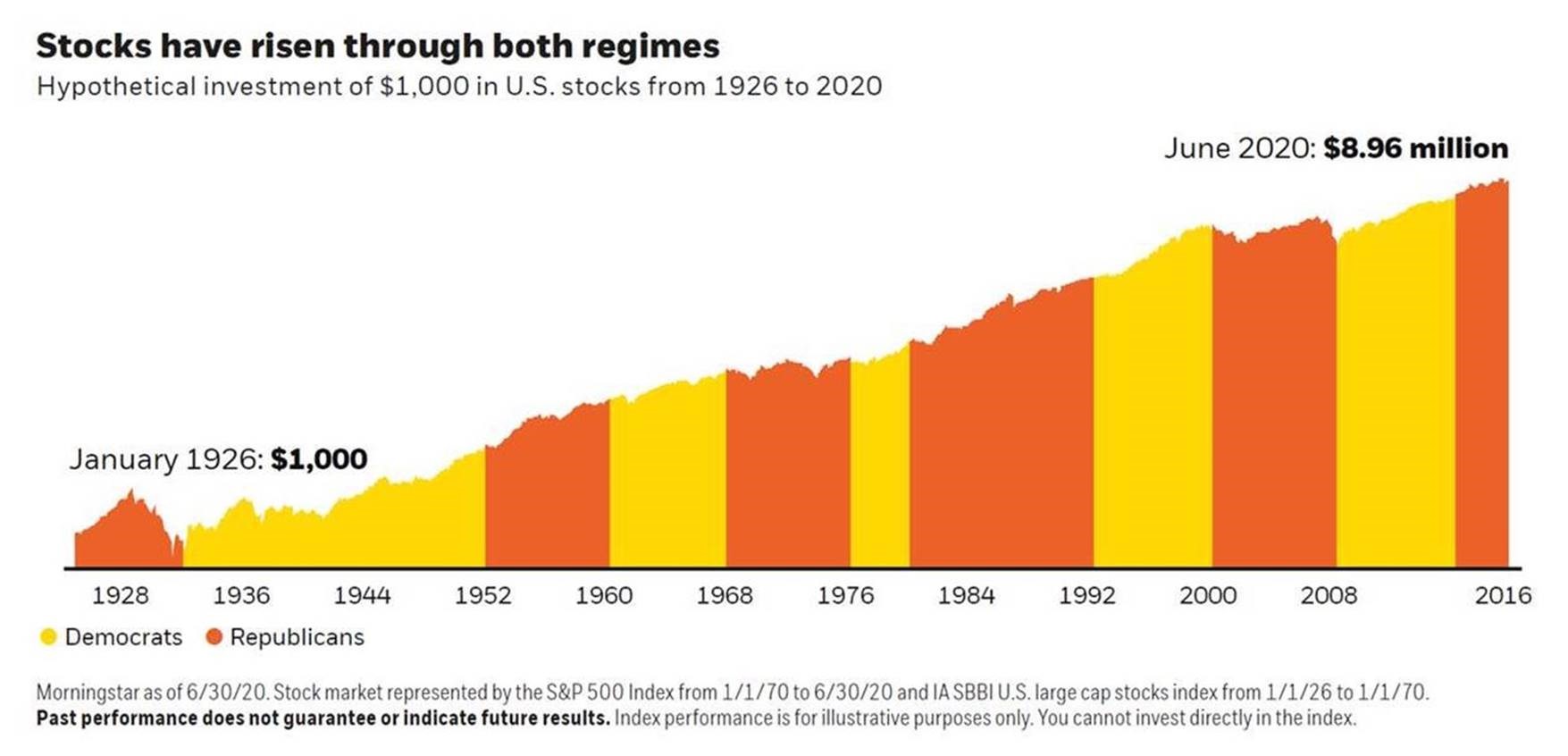

The popular headline of the week/month is inflation. We haven't seen inflation (or defaltion) in the news this much since it was Tom Brady driving the headlines. Rene gives us a history lesson on inflation and outlines what is drivng the current spike and what we're thinking about/paying attention to looking forward. [...]