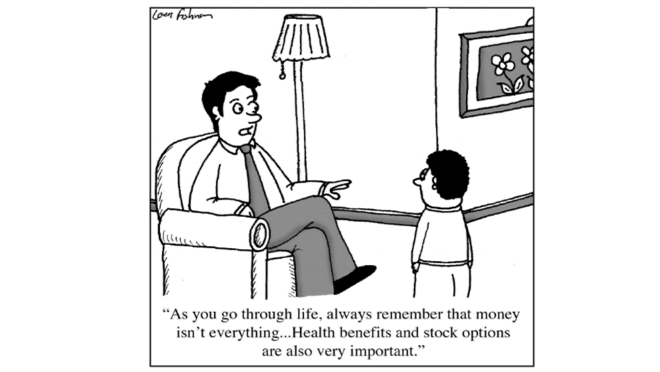

RJ’s Commentary January 2020

You all know we are a financial planning firm, investments are but a piece of your overall planning. Having said that, once a quarter we do let the investment folks have their time in the sun and allow them to share their thoughts. Hope you find Rene's quarterly commentary helpful. It has been 5 days [...]