Single Point of View

Single Point of View is our way to occasionally share planning ideas relating to personal finance. Our goal is to pass along concepts that you may not be exposed to on a daily basis.

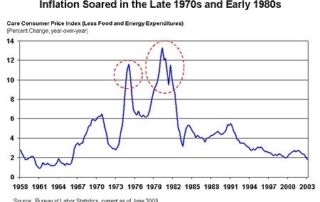

1970s Inflation Redux?

Should we fear a replay of the 1970’s High-Inflation era? Today’s jobs report points to an unemployment rate of 3.7% - the lowest since 1969, the year when the worst outbreak of inflation began to be felt. From 1969 to 1982 inflation spiked to 7.3% annually and wrecked stock and bond returns – which were negative in real terms. Though [...]

Double-Check Your Tax Withholding This Year

We thought we'd share this great article (click below) highlighting the importance of reviewing your tax situation this year, specifically with respect to any withholdings from W2 income. In the wake of last year's tax reform it's more important than ever to review your paystub to ensure tax withholdings are accurate for your individual circumstances. It's worth taking the time [...]

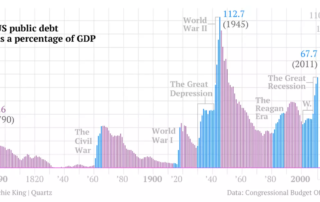

Our Growing National Debt & Your Bonds

A significant portion of our client’s portfolios are invested in the US Bond market, so I wanted to put the current Federal debt picture in the appropriate perspective. The punch line is that we are not on the cusp of The Financial Apocalypse as some pundits will have you believe. With the help of our Bentley University summer intern – [...]

How To Protect Your Children From Identity Theft

We wanted to share this great article from the Wall Street Journal, "New on Parents’ To-Do List: Checking Children’s Credit History". In it you will find some important resources for protecting your children from identity theft. Experian estimates that identity theft will affect one in four children before they become an adult. It's important to stay on top of this, [...]

Elf Spotting, Financial Advisors & Fiduciaries

It's been just over 2 years since I made this post. The sentiment of the video and my remarks are as true today. It was circled back to me from a great friend and client today, so I thought I would re-share it with all of you.... Thank you John Oliver for explaining the problems in the financial advice [...]

Charitable Giving in a Post-Tax Reform World

The tax law changes at the end of 2017 drastically changed the landscape for deductible expenses – these changes have a major impact on tax optimization and planning strategies going forward. Back-up – what are deductions? Taxpayers have two deduction options when filing a return. They can take the standard deduction (a flat amount based on your filing status) OR [...]