I read a study recently that stated only 30% of those who refer to themselves as financial advisors actually provide any level of financial planning. One can only imagine that within that 30%, it is only a subset who are truly focused on planning vs. those who provide some planning as an ancillary service.

So what are the other 70% of “financial advisors” doing. They are most likely insurance salespeople, or, strictly investment advisors. To be clear, there is absolutely nothing wrong with insurance sales and investment management – we need those services.

The issue we have with the industry is in how confusing it must be to the general public. When looking for financial advice, the natural thing to do is find a financial advisor. How does one know if they are getting a financial advisor who is a financial planner, investment advisor, or insurance salesman if they all have the same title?

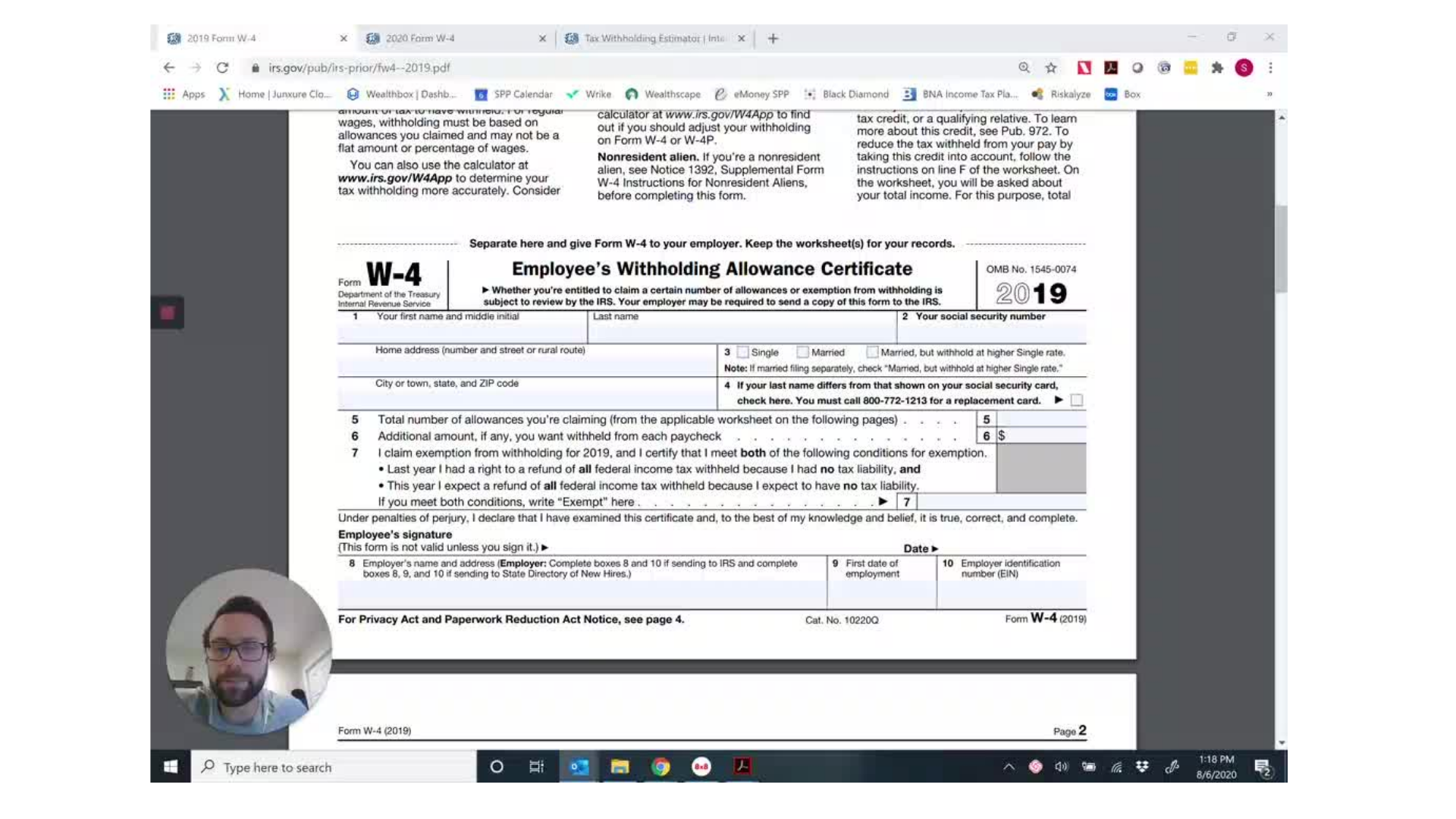

You may have seen in the news last month that the Department of Labor released a ruling which expanded the definition of a fiduciary under what is known as ERISA.

I’m guessing your response to the above sentence is “What the hell does that mean?”

Essentially, it changes the game for many of those providing advice on retirement assets. Now, everyone must act as a fiduciary – which simply means they must act in their client’s best interest.

“Wait, some advisors haven’t had to act in their client’s best interest before this?” Technically, no.

At Single Point we have always acted as a fiduciary, and have always been held to a standard of acting in our clients’ best interest: both by ourselves, and by those that regulate us.

In fact, we feel we are ahead of the industry in this sense with our Personal CFO retainer fee structure. By charging a flat fee for all of our advice and services, we have tried to eliminate many of the conflicts of interest that traditionally exist in our industry. If our fee will not change based on the advice we give you, there is no financial incentive to do anything but what is in your best interest. We felt it was very important to not just be a fiduciary, but, to align our compensation model to that role. This approach allows us to focus on what is most important to you.

We are happy about this ruling as we feel it is a first step in making things better for consumers of financial advice.