Single Point of View

Single Point of View is our way to occasionally share planning ideas relating to personal finance. Our goal is to pass along concepts that you may not be exposed to on a daily basis.

The Physics of Personal Investing

A Physics Lens on Market Fear In physics, the world is governed by forces—predictable relationships that describe how objects respond to change. One of the most fundamental is Newton’s Second Law: Force = mass × acceleration. It tells us that the impact an object feels is not only a function of the change around it, but also of the [...]

Giving as a Way of Living

As the season of gratitude approaches, we’re reminded that giving isn’t confined to a single day, a donation drive, or a line item on a budget. True generosity — the kind that strengthens communities and enriches our lives — is a way of living. In a recent episode of Money Isn’t Scary, our colleague Meghan Dwyer sat down with [...]

You Can’t Predict the Future — But You Can Prepare for It

What can financial planning learn from military strategy? More than you might think. In this reflection, Stephen Yoskowitz shares how his time working alongside U.S. forces shaped the way he approaches uncertainty, discipline, and long-term readiness. Strategic Readiness: Why Comprehensive Financial Planning Resembles Military Strategy In the late 2000s through the mid-2010s, I was a civilian analyst [...]

How “The One Big Beautiful Bill” Affects Me?

Each time there’s a major tax bill, the natural question is: “How will this affect me, my taxes, and my planning?” For readers that work with an advisor, a specific conversation in the context of your life and planning will invariably take place over the coming months. To aid in those conversations and for those of you reading this [...]

Update to Professor Rene’s Market Update – April 2025

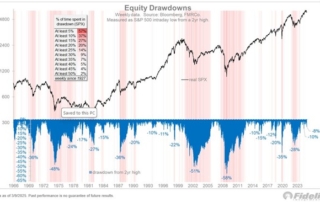

Last month, Professor Rene provided an update of the current market given the recent downturn (see below). Given the continued volatility here is an update to that update. With yesterday’s announcement of reciprocal tariffs the market is now down -13% from its Feb 19 high. Since my last post of Friday March 14 the market was actually flat through [...]

Professor Rene’s Market Update – March 2025

For now, the S&P 500 is down 8% from its recent (all-time) high on Feb 19. It’s an uncomfortable feeling not knowing whether an 8% drop will turn into a 25% bear market, but some things in life are unknowable – even to the most astute investors. It is key to remember that through all the previous market downturns, [...]