For many people, fall marks the beginning of the open enrollment period for health insurance and other benefits. For SPP clients you can expect to hear from Mary Casady in the coming weeks to collect some data for analysis (assuming you are either on Medicare/Exchange or have workplace coverage enrollment this time of year).

This is an important time to review your elections and ensure that they are still meeting the needs of you and your family. We know how complex this can be and are here to help you figure out your options. Below is some more information that can help you get started on this process.

Medicare Enrollees

Medicare open enrollment begins today, October 15th and runs through December 7th.

For our clients currently enrolled in Medicare, who have a decision to make on supplemental or Part D (prescription drug) coverage for 2019, we will work with you to compile the information and determine the best elections for your situation. Mary will be reaching out to you over the next coming weeks to gather the information needed from you to help make those decisions.

If you’d like to begin reviewing supplemental and Part D plans, we suggest going through the Medicare Plan Finder’s “Personalized Search,” which can be found through the following link: https://www.medicare.gov/find-a-plan/questions/home.aspx. Make sure to have your Medicare card, zip code, list of prescription drugs (including dosage and amount), and pharmacies readily available to get the most out of this process.

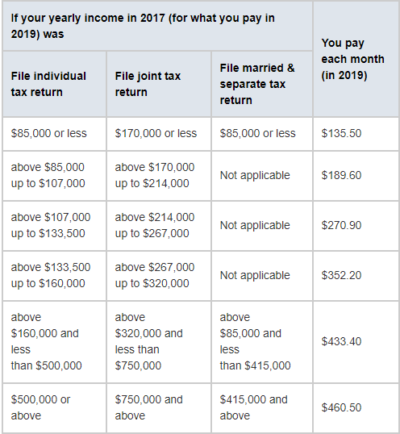

For Part B Medicare recipients, the 2019 premium amounts will be as follows:

You should also be aware that with the new Medicare cards being mailed out this year, there has been an increase in fraud targeted to Medicare recipients. As a reminder, there is no activation process or fee required for your new card.

Workplace Insurance

This is typically the time of year for employer open enrollment and employees can select their benefit packages for the year ahead. It is important to review the plans available to you on an annual basis to evaluate changes – both within the plans being offered and relating to you and your family.

Considerations include whether your providers are “in-network” and the type of plan to select, such as an HMO or PPO. Additionally, your employer may offer a Health Savings Account (for those in High Deductible Health Plans) or a Flexible Spending Account that you may want to consider.

Beyond health insurance, there are many other voluntary benefits available through your employer that you may also sign-up for during this period. Coordinating with your spouse may be helpful to ensure you are taking advantage of the best options available through either employer and meeting the needs of your household.

Marketplace & Individual Health Insurance Plans

Open enrollment for marketplace and individual health insurance plans runs from November 1st through December 15th. More information can be found here: https://www.healthcare.gov/keep-or-change-plan/.